Updated: December 15, 2025

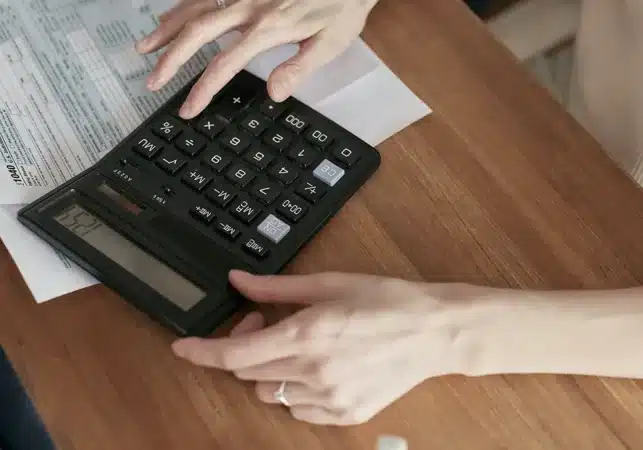

Capital gains tax in Portugal is the tax you pay when you make a profit from the sale of an asset, most commonly real estate or investments. It is a type of tax that falls under the personal income tax (IRS) category and is particularly important for homeowners, foreign investors, and expats.

Portugal’s tax system has evolved over the years, introducing new rules that reduce the disparity in taxation between Portuguese residents and non-residents. The tax rates vary based on the worldwide income for residents, or the portion considered taxable for non-residents.

Understanding the deductible expenses and compiling the correct documentation can significantly decrease your Capital Gains Tax (CGT) liability. In this guide, we cover everything you need to know about the capital gains tax rate in Portugal, including formulas used to calculate the tax, as well as various reliefs and exemptions.

Read more about:

Key Takeaways about Capital Gains Tax in Portugal

- In most cases, capital gains (CGT) are taxed at a flat rate of 28 percent. But, if you sell shares in small or micro companies that are not listed on the stock exchange, only 50 percent of capital gains will be taxed.

- Capital gains on real estate are almost always subject to the progressive rates, from 12.50 percent to 48 percent.

- You can be fully exempt from CGT if you sell your primary residence and reinvest the entire proceeds (or a proportional amount) into acquiring, constructing, or improving a new primary residence. The new home must be in Portugal, the EU, or the EEA.

What is Capital Gains Tax (CGT)?

Capital Gains Tax is a tax that you are liable to pay when you make a profit from the sale of a Portuguese property or another capital asset. Personal belongings aren’t taxed, and inheritances are subject to a small Stamp Duty.

Capital Gains Tax is a tax that you are liable to pay when you make a profit from the sale of a Portuguese property or another capital asset. Personal belongings aren’t taxed, and inheritances are subject to a small Stamp Duty.

The 28 percent flat rate is the default for capital gains from shares and other securities. However, it does not apply to other assets, such as real estate. Gains on real estate are taxed at progressive rates, from 12.50 percent to 48 percent.

How much tax you owe depends on your residency status, how you own the asset, and whether the asset, or property, is your primary residence.

CGT in Portugal from real estate and investments is viewed as personal income. Therefore, they are subject to Portuguese IRS (Imposto sobre o Rendimento das Pessoas Singulares). You can learn more about the progressive IRS tax rates in our ultimate guide to taxes in Portugal.

When does Capital Gains Tax apply in Portugal?

When does Capital Gains Tax apply in Portugal?

Capital Gains Tax (CGT) is triggered in Portugal at the moment you make a profit from the sale or transfer of a qualifying asset acquired after 1988. The tax is calculated and paid in the subsequent tax filing period.

Here are a couple of factors that determine when you are liable for the tax:

- Trigger event: You trigger a CGT event the moment you sell or dispose of part, or all, of a capital asset (such as property, stocks, bonds, or investment funds). If you sell an asset at a loss, you can use it to offset other capital gains.

- Asset acquisition date: CGT only applies to the sale of assets (particularly real estate) that were acquired on or after 1 January 1989. Any real estate or investments purchased before 1 January 1989 are exempt from Portuguese CGT.

- Reporting obligation: The Portuguese tax year runs from 1 January to 31 December. You report the CGT event in the year you sold the asset. You must report your capital gains on your annual Personal Income Tax (IRS) return, which is typically filed between April and June of the following year.

Reporting CGT in Portugal is done through an IRS return known as Modelo 3, specifically using Annex G (or G1 in some instances). You will use the Portal das Finanças to fulfill most of your tax obligations, such as paying taxes, downloading documents, and submitting formal tax queries.

What assets are subject to Capital Gains Tax in Portugal?

What assets are subject to Capital Gains Tax in Portugal?

Capital Gains Tax in Portugal (CGT Portugal) applies to profits you make from selling or transferring specific types of assets.

Capital Gains Tax in Portugal (CGT Portugal) applies to profits you make from selling or transferring specific types of assets.

These include:

- Residential property (such as main homes, secondary homes, or rental properties)

- Commercial property (such as selling commercial real estate or land)

- Stocks and shares (such as gains from stock options and selling shares in certain companies)

- Corporate and government bonds

- Mutual funds and investment funds

- Derivatives and other complex financial instruments

- Cryptocurrency

If you want to learn more about how crypto taxes work, check our guide on Portugal for crypto traders.

What’s new from 2023 to 2025?

What’s new from 2023 to 2025?

Since 1 January 2023, non-residents who sell property in Portugal follow the same tax rules as residents: only 50 percent of the profit is taxable, and the rate depends on your total global income.

In 2025, Portugal’s income tax brackets range from approximately 12.50 percent to 48 percent, and your real estate gains are taxed within these brackets after being combined with your other earnings.

In 2024, there were changes to the Personal Income Tax. Under the new PIT Code, gains or losses from selling traded securities or units in investment funds can qualify for partial tax relief.

According to PWC Portugal:

- You can exclude 10 percent of the gain if you held the asset for more than two years but less than five.

- You can exclude 20 percent of the gain if you held it for at least five years but under eight.

- You can exclude 30 percent of the gain if you kept the asset for eight years or longer.

Since 2023, capital gains from crypto assets have been taxed at 28 percent for short-term gains (those held for less than 365 days), while long-term gains are often exempt.

The Non-Habitual Resident (NHR) tax regime provided significant relief on capital gains for those who qualified. But that has changed since the regime ended in January 2024 and was replaced by the NHR 2.0.

Note: Properties bought before 1 January 1989 are still exempt from Capital Gains Tax.

How to calculate Capital Gains Tax (CGT) for Portuguese residents?

The Portugal capital gains tax for residents is calculated based on the type of asset you sell. You determine the net gain, apply a reduction, and calculate the final tax.

Here is a step-by-step guide for calculating CGT for Portuguese residents.

Step 1: Calculate the net capital gain

You can use the following formula:

Net Gain = Selling Price – (Adjusted Acquisition Value + Deductible Costs)

Step 2: Apply the taxable reduction

Portugal offers significant relief for real estate sales, which you can calculate based on this formula:

Taxable Gain = Net Gain x 50 percent

Only 50 percent is subject to tax; the other half is exempt.

Step 3: Calculate the final tax due

The 50 percent taxable portion is part of your annual personal income, such as salary, pension, or rental income.

The total amount is then taxed according to the progressive Personal Income Tax (IRS) rates in Portugal, which vary from 12.5 percent to 48 percent. Individuals with the highest income also pay a solidarity surcharge.

Your CGT liability is determined by the marginal IRS rate applicable to your total aggregated income.

Main home exemptions for Portuguese residents

Main home exemptions for Portuguese residents

Portugal offers two exemptions for Portuguese residents who sell a property they used as their primary residence. You can benefit from reinvesting the proceeds in a new primary residence (the “rollover rule”), and/or if you are a retiree, you can reinvest into your pension or long-term savings plan.

Portugal offers two exemptions for Portuguese residents who sell a property they used as their primary residence. You can benefit from reinvesting the proceeds in a new primary residence (the “rollover rule”), and/or if you are a retiree, you can reinvest into your pension or long-term savings plan.

If you are reinvesting the proceeds into a new home, you are exempt of Portuguese capital gains tax by satisfying the following criteria:

- You can prove you’ve registered the property in your name.

- The new permanent residence is located in Portugal or in another country within the European Union or the European Economic Area that has a tax treaty with Portugal.

- You buy the new home within a specific time window. This window begins two years (24 months) before you sell your first home and ends three years (36 months) after that sale.

- You settle into your new residence within six months of the three-year deadline.

- You reinvest the entire proceeds, including incidental costs, legal fees, and real estate agent fees.

You can avoid CGT in Portugal if you put the money into a life assurance policy. These policies are a smart way to hold your investments.

If you choose a pension fund instead, you must follow a specific technical rule, which indicates the annual payments you receive cannot be higher than 7.5 percent of the fund’s total value.

Note: It is highly beneficial to consult with a financial tax advisor to understand your tax obligations better. They can help calculate the Capital Gains Tax rate in Portugal, based on your specific circumstances.

How to calculate Capital Gains Tax for non-Portuguese residents?

As of 1 January 2023, the Portugal capital gains tax for non-residents is the same as for residents, taxed at 50 percent of the capital gains.

Portugal uses progressive tax brackets to calculate the CGT based on your worldwide income. For non-residents, the rates range from 12.50 percent to 48 percent on Portuguese-sourced capital gain. They are not taxed on their foreign income itself.

The table below covers the Personal Income Tax rate (IRS) in mainland Portugal.

Taxable income (€) | Tax rate (in percentage) | Deductible Amount (€) |

Up to 8,059 | 12.50 | 0 |

8,059 to 12,160 | 16.00 | 282.07 |

12,160 to 17,233 | 21.50 | 950.91 |

17,233 to 22,306 | 24.40 | 1,450.67 |

22,306 to 28,400 | 31.40 | 3,011.98 |

28,400 to 41,629 | 34.90 | 4,006.10 |

41,629 to 44,987 | 43.10 | 7,419.54 |

44,987 to 83,696 | 44.60 | 8,094.51 |

Over 83,696 | 48.00 | 10,939.90 |

Source: PWC Portugal

Note: As a non-resident, you should always consult with a tax advisor about any tax obligations. Your final tax liability may be affected by the tax treaty agreement between Portugal and your country of residence, which determines which country has the primary right to tax the gain.

Capital Gains Tax for corporate real estate

Capital Gains Tax for corporate real estate

Capital Gains Tax (CGT) on real estate sold by a company in Portugal is not subject to a separate CGT rate. The profit is treated as part of the company’s ordinary income and is taxed under the Corporate Income Tax (Imposto sobre o Rendimento das Pessoas Coletivas or IRC) regime.

The taxation is calculated based on a standard rate subject to surcharges and potential reductions. For companies, the calculation is done at the accounting level, and the gain is taxed as a business profit.

You can calculate the net gain with the following formula:

Sales Proceeds – (Acquisition Value – Accumulated Depreciation/Amortization)

The main difference between personal and corporate taxation is the inclusion rate. Exactly 100 percent of the net gain is included in the company’s taxable profit. But the gain itself can be partly deferred.

The Portuguese tax law allows for 50 percent of the net capital gain to be excluded from the company’s taxable profit in the year the asset is sold. The amount excluded from taxable profit is then deducted from the acquisition cost of the new asset. The law applies to the new asset if the sales proceeds are reinvested in qualifying fixed assets, such as real estate, intangible, or biological assets.

The taxable gain is then taxed at standard IRC rates, which are progressive based on the company’s total profit.

For corporate real estate, gains vary from 21.5 percent for small companies in a low-surcharge municipality to over 30 percent for very large companies due to the state surcharges.

The table below covers the corporate income tax (IRC) rates in Portugal:

Taxable profit | Mainland Portugal | Surcharges (added) |

Standard rate | 20 percent (general rate for 2025) | Up to 1.5 percent based on local municipal surcharge |

SME/Startup rate | 16 percent on the first €50,000 of taxable income | Up to 1.5 percent based on local municipal surcharge |

State surcharge | 3 to 9 percent on profits exceeding €1.5 million | Applied progressively to higher profit thresholds |

Considering buying property in Portugal? Contact a local buyer’s agent or real estate agent to navigate the property landscape and maximize your investment returns. Agents can connect you with tax advisors, contractors, and real estate lawyers. With expert help, you can better understand the Capital Gains Tax on property.

Capital Gains Tax Portugal: Deductions for Residents and Non-Residents in Portugal

There are instances where both residents and non-residents can apply for cost deductions from the Capital Gains Tax amount. These include:

- The request for the energy certificate

- The IMT

- The commission paid to the real estate agency

- Solicitor costs

- The deeds

- Charges for the appreciation of the property – for maintenance and conservation works, to increase the value of the property carried out in the previous 12 years, and that are duly documented

Key Capital Gains Exemptions and Reliefs in Portugal

The key Capital Gains Tax (CGT) exemptions and reliefs in Portugal apply to:

- Primary residence investments (residents only). You can get a full or partial CGT exemption when you sell your main home in Portugal. To qualify, the net sale proceeds must be reinvested into a new primary residence in the EU or EEA. You must complete the process within 36 months after the sale or 24 months before the sale.

- Retirees or seniors. If the seller is over 65 years old or retired and reinvests the proceeds from their primary home into a pension fund or a long-term savings product within six months, they are eligible for a full CGT exemption.

- Pre-1989 properties. Properties obtained before 1 January 1989 are often exempt from Capital Gains Tax when sold.

Read more about property taxes in Portugal in our ultimate guide.

How to reduce your Capital Gains Tax exposure in Portugal?

With careful planning, expert advice, and correct documentation, you can minimize your tax burden. The capital gains arising from selling a primary residence can be fully or partially exempt from tax if the net proceeds are reinvested into a new primary residence in Portugal, the EU, or the EEA within a 36-month window.

With careful planning, expert advice, and correct documentation, you can minimize your tax burden. The capital gains arising from selling a primary residence can be fully or partially exempt from tax if the net proceeds are reinvested into a new primary residence in Portugal, the EU, or the EEA within a 36-month window.

Certain types of life insurance policies can offer significant tax advantages. For example, Unit-Linked Life Insurance (Seguros de Vida), is one of the most efficient tools for transferring wealth to beneficiaries in Portugal.

The documentation required to lower your taxable gain can include:

- Acquisition deed

- Sales deed/contract

- Proof of payment, such as IMT (Property Transfer Tax), Stamp Duty (Imposto de Selo), Notary or legal fees paid at the time of purchase.

- Energy certificate

Note: You may need to provide additional documentation, such as invoices, to support eligible costs. These invoices must comply with the rules set by the Portuguese tax authority or Autoridade Tributária e Aduaneira (AT).

Goldcrest: How We Can Help You

Goldcrest is a buyer’s agent that is based in Lisbon. We provide expert, impartial advice on real estate investments and how to buy property in Portugal. From scouting out the perfect property through to property acquisition, we have you covered throughout the process.

If you are looking to purchase property in Portugal, don’t hesitate to get in touch. Our team of skilled experts is available to solve all your real estate doubts, helping you with the property search and offering insightful expertise and strategic advice.

Why choose Goldcrest?

- Local knowledge: With offices located across Portugal, our presence nationwide allows us to assist you personally across the country.

- Independent service: As an independent buying agent, we do not represent any development or project. Our service is entirely tailored toward each individual client, providing you with everything you need to secure the perfect property at the best possible price. As an impartial advisor on the market, we work solely on behalf of our client and provide a service tailored to your needs and requirements.

- Streamlined process: Our real estate agents speak English and Portuguese, and our service is completely focused on providing you with a hassle-free buying experience, saving you time.

- Experienced team: Our expert real estate team has a vast local knowledge of the Portuguese property market. We have cutting-edge technology and metasearch tools at your disposal to provide full market coverage, ensuring the best investment choices and negotiated prices.

- Network of partners: We have a close network of partners, including lawyers, property management services, builders, architects, designers, and landscape gardeners, again saving you time and hassle by providing you with trusted experts in their field of work.

Frequently Asked Questions about Capital Gains Tax in Portugal:

How to calculate capital gains tax?

The capital gain is calculated by taking the sale price and subtracting the acquisition cost and deductible expenses. Only 50 percent of the net gain is then added to your annual income and taxed at progressive Portuguese income tax rates from 12.50 to 48 percent.

Is Portugal a tax haven?

No, Portugal is not a tax haven.

Does Portugal tax US capital gains?

Yes, Portugal taxes US-sourced capital gains if you are considered a tax resident in Portugal. You are taxed on your worldwide income from selling US assets, like US stocks, mutual funds, or non-Portuguese real estate. But you don’t get taxed twice because of the Double Taxation Agreement between the US and Portugal.

How much is Capital Gains Tax in Portugal?

The default capital gains tax in Portugal is 28 percent for gains from shares and other securities, but it is not a universal rule and does not apply to assets like Portuguese real estate investment.

How does Capital Gains Tax work in Portugal?

Capital Gains Tax in Portugal applies when you sell assets like property, crypto, or investments for a profit. Portugal taxes residents on worldwide gains, while non-residents pay tax only on Portuguese assets. Portugal taxes 50 percent of real-estate gains at progressive rates, and it taxes crypto gains at 28 percent when held for less than 365 days.

How to avoid capital gains tax in Portugal on property?

You can avoid Capital Gains Tax (CGT) in Portugal on property through two main pathways: the principal residence (rollover rule) or the retiree reinvestment.

Is there a "wealth tax" in Portugal?

No, Portugal only has an additional property tax referred to as Adicional ao Imposto Municipal sobre Imóveis (AIMI). AIMI tax applies to owners of shares in Portugal real estate with a value of more than €600,000.

What costs can be deducted from Capital Gains Tax on property?

Expenses such as acquisition costs, improvement costs, and sales costs can be deducted from the Portuguese capital gains tax on property. But you must have the property invoices and your Portuguese tax number (NIF) to claim these deductions.

What is the capital gains tax on shares or securities?

The Portugal capital gains tax on shares, bonds, and securities is 100 percent. Tax residents can choose to apply either a flat 28 percent or a progressive income tax rate if their overall marginal rate is below 28 percent.

How much is the capital gains tax in Portugal on rental income?

Rental income is often subject to a flat tax rate. For non-residents, the rate is 25 percent for residential properties (long-term housing), but a 28 percent rate may apply in specific cases, such as corporate or rural rentals (non-housing).