Updated: December 23, 2025

Portugal’s short-term rental market works under a high-stakes regulatory environment. Without an AL (Alojamento Local) license, you cannot register your vacation rental on platforms such as Airbnb or Booking.com.

While it was relatively easy to secure an AL License, new restrictions made it more difficult for investors who wanted to rent out their property on a short-term basis. However, as of October 2024, these restrictions have eased.

In this ultimate guide, we take a closer look at the new rental laws in Portugal, the top areas for investment, risks, and practical considerations. We’ve also included a step-by-step process for registering your property as a short-term rental.

Stick around to read about:

Key Takeaways about Short-term Rentals in Portugal

- The new rental laws in Portugal revoked national restrictions, restored license transferability, and gave municipalities primary power to set local rules for short-term rentals.

- Municipal containment zones ban new AL registrations in densely populated areas, while the national law sets AL caps at nine rooms and 27 guests.

- Despite the recent changes, the best locations to invest in short-term rentals remain Lisbon, Porto, and the Algarve, due to their high occupancy rates, nightly rates, and rental yields.

- AL operating costs vary based on location and property, but they are often 30 to 40 percent of revenue, which covers management fees, cleaning, utilities, and mandatory insurance.

Latest Changes: 23 October 2024

The Portuguese government has recently introduced new laws (under Decree-Law No. 76/2024, as of late 2024/early 2025) that roll back certain restrictions imposed by the Mais Habitação (More Housing) program in 2023.

The new law gives municipalities the power to create their own specific rules for AL activities in their area. Any municipality that has more than 1,000 registered short-term rentals has one year to declare whether or not it will exercise this power to establish regulations.

Municipalities can suspend new AL registrations for up to one year while regulations are in place in designated containment areas and popular tourist destinations.

What are the new short-term rental laws in Portugal?

In short, this package, to respond to problems and complaints associated with the AL, has revoked the following:

In short, this package, to respond to problems and complaints associated with the AL, has revoked the following:

- Suspending the issuance of new registrations of AL establishments;

- Expiry of inactive registrations when there was no proof of the maintenance of the activity;

- Non-transferability of licenses;

- The requirement to review in 2030 all existing records on the date of publication of the Mais Habitação program (2023);

- The rule providing that AL registrations were valid for renewable five-year periods; and

In addition to this:

- The condominium assembly of a building where an AL is installed is given the power to oppose the operation and can request the municipal president to cancel the registration.

- AL capacity is now also capped at a maximum of 27 guests and nine rooms (except for hostels).

- Municipalities are now allowed to establish an “AL Ombudsman” or similar body to handle disputes and supervise the activity.

These changes took effect on November 1, 2024.

Short Term Rentals in Portugal: Latest Statistics

Portugal registered a record number of tourists in 2024, closing the year with 88.3 million overnight stays. According to Statistics Portugal (INE), the total number of guests who stayed in any official, commercial lodging was 34 million. This represents a 1.7 percent growth rate in overnight stays compared to 2023.

Record tourist numbers have fueled the interest of many investors looking to capitalize on Portugal’s continuous tourism boom. In fact, short-term rentals in prime tourist areas are often more profitable than long-term rentals in Lisbon, offering 15 to 35 percent higher gross revenue during peak season.

What is considered a short-term rental in Portugal?

Short-term rentals in Portugal are furnished properties, such as villas, houses, or modern apartments, that are rented out to tourists for a short period, usually less than 30 days at a time. You advertise the property online, and guests pay a fee to stay.

The rental property can include hotel-like services, such as cleaning, reception desk, or pet-friendly complementary services. The official Portuguese name for this type of rental is Alojamento Local (AL).

However, the term AL doesn’t just mean a rented apartment; it also includes other types of tourist lodging, like hostels and guesthouses. You can read more about the Alojamento Local (AL) in Portugal in our comprehensive guide.

Specific accommodation requirements

For a property to be considered a short-term rental in Portugal, it must meet the local accommodation requirements. These include:

For a property to be considered a short-term rental in Portugal, it must meet the local accommodation requirements. These include:

- Complete furnishing as well as a fully-equipped kitchen. It also needs at least one toilet for every four rooms or ten guests. If several rooms share a private bathroom, it must have a door with a lock for privacy.

- The property can have up to nine bedrooms and accommodate a maximum of 27 guests, unless it’s a hostel.

- It must be well-maintained, with working electrical systems, running tap water, and proper connections to the public water and sewage networks. Each unit needs at least one window or balcony for ventilation.

- Shared facilities must include at least one toilet, washbasin, and shower for every six guests.

- A property must have a first aid kit, a fire blanket, and a fire extinguisher, alongside an information book written in Portuguese, English, and at least two other foreign languages.

- A reception service must be available, either in person, by phone, or online. The property owner should provide clear house rules and a phone number for communication. A property management service in Portugal can help with the ongoing maintenance.

- Operators must cooperate with national authorities by reporting the number of guests, overnight stays, and other required data.

What's the difference between short-term and long-term rentals in Portugal?

Renting in Portugal is categorized into two main categories: short-term and long-term rentals. The main difference is that a short-term rental (AL) is a hospitality business subject to municipal tourism regulations, while a long-term rental is a permanent housing arrangement subject to tenant protection laws.

If you already have a property in the city center but don’t have a license, you can offer mid-term accommodation. This third category is recently becoming more popular for hosting digital nomads and young professionals. It relies on long-term rental rules (no AL license needed) but uses a special “temporary-purpose” lease contract (contrato de arrendamento para fins transitórios) which must clearly state the temporary reason for the stay.

The table below provides a quick overview of Portugal short-term rentals vs long term rentals.

Feature | Short-term rental (Alojamento Local) | Long-term rental (Arrendamento de longa duração) |

Average duration | Up to 30 days | 1 year or more (often 3 to 5 years, legally minimum is 1 year for permanent residence) |

Purpose | Temporary stay for tourists, visitors, or business travelers. | Permanent residence for local citizens, families, and long-term expats. |

Legal framework | Governed by Tourism Laws (Decree-Law No. 128/2014 & updates) | Governed by Housing Laws (New Urban Lease Regime - NRAU) |

License required | Yes. Requires an official AL License (RNAL registration) from the municipality. | No. Requires a written contract (Contrato de Arrendamento) registered with the Tax Office. |

Available services | Furnished and includes hotel-like services, such as cleaning, linens, and check-in. | Often unfurnished or partially furnished where the tenant pays all utilities and handles cleaning. |

Management effort | High. Constant turnover, cleaning, check-ins, guest communication, and dynamic pricing. | Low. Stable income, minimal turnover, and low management once the contract is signed. |

Income potential | High, especially in peak tourist season. | Lower but more stable and predictable monthly income. |

What are short-term rental containment zones?

Containment zones are central neighborhoods in Lisbon and Porto with an overload of short-term rental properties, created to protect the local housing supply. In 2019, the Lisbon City Council introduced rental containment zones that limit how many AL licenses they can issue.

For example, in Lisbon, new AL licenses are no longer allowed in six parishes and nine neighborhoods. The historic city center has a full ban on opening any new short-term rental units, such as in Santa Maria Maior, Misericórdia, and Santo António.

Meanwhile, Porto has a ban on new AL properties in five parishes that make up the historic center, such as Sé, Vitória, and São Nicolau.

How to obtain a short-term rental (AL) license in Portugal?

To get an AL license for a short-term rental in Portugal, you must submit a prior notification (comunicação prévia) online via the ePortugal portal (Balcão Único Eletrónico). You provide the authorities with a sworn statement.

To get an AL license for a short-term rental in Portugal, you must submit a prior notification (comunicação prévia) online via the ePortugal portal (Balcão Único Eletrónico). You provide the authorities with a sworn statement.

Before you can apply for your AL license, you must first tell the Tax Office (Finanças):

- “Your Portuguese NIF number.”

- “I’m starting a business.”

- “The business I am starting is short-term tourist accommodation (using CAE Code 55201).”

This registration provides you with a tax certificate called Declaration of Commencement of Activity, which is a basic requirement for the AL application.

After a successful application, you will receive an AL number (RNAL registration), which is a provisional license you can use to operate and advertise the property. The municipality verifies compliance of the property within 60 to 90 days and issues an AL license.

Here are the main CAE codes used for short-term rentals in Portugal:

CAE Code | Description | AL type |

55201 | Furnished accommodation for tourists | The most common code for renting a whole apartment, house, or villa. |

55204 | Other short-stay accommodation | A code for lodging establishments, such as guesthouses and certain types of AL, where you rent individual rooms. |

55202 | Tourism in rural areas | A code for properties that qualify under rural tourism, such as converted farms or historical buildings in low-density areas. |

Required documents

To apply for an Alojamento Local (AL) in Portugal, you will need the following documentation:

- Valid passport or ID

- NIF certificate (Número de Identificação Fiscal or Portuguese tax number)

- Proof of ownership

- Lease or title document

- Usage license (Licença de Utilização)

- Declaration of Commencement of Activity

- Civil liability insurance policy

- Sworn statement (Termo de Responsabilidade)

- Property information (such as intended start date, modality of the AL, and maximum capacity)

Step-by-Step: Registering Your Short-Term Rental in Portugal

To register your Alojamento Local (AL) for short-term, follow the steps below:

- Step 1: Obtain a NIF in Portugal and establish a tax activity under the correct CAE code.

- Step 2: Get a mandatory civil liability insurance that covers the AL activity (such as fire risks, property damage, and damage to guests).

- Step 2: Submit a prior communication to your local town hall (Câmara Municipal) via an official government website with ownership documents, property details, and a sworn statement.

- Step 4: Ensure the property has all the mandatory safety equipment and information book.

- Step 5: Receive your AL license and RNAL registration.

- Step 6: Mount the official “AL” identification plate near the entrance.

How are short-term rentals taxed in Portugal?

Taxation for short-term rentals in Portugal is treated as business income (Category B) and is subject to different rules than standard long-term rental income. The taxation depends on your annual income, your tax residency status, and which tax regime you select.

Tax regimes

Tax regimes

- Simplified regime: Only a percentage of your gross rental income is considered taxable profit. For example, if you rent out an apartment or a house, 35 percent of gross income is taxed. For lodging or hostels, 15 percent of gross income is taxed. The taxable profit is then added to your total annual income and taxed at Portugal’s progressive IRS rates.

- Organized accounts: This regime is mandatory if your gross annual income exceeds €200,000. Taxable Income is calculated based on actual profit and is taxed at progressive IRS rates. To find out more, check our guide on property taxes in Portugal.

Value added tax (VAT)

Value added tax (VAT)

If your gross annual turnover is less than €13,500 (or €15,500 for the first year), you can opt for the VAT exemption. You do not charge VAT to guests, but you cannot deduct VAT paid on your expenses.

If your income exceeds the exemption threshold, you must register for VAT. The reduced VAT rate on AL services (accommodation) is 6 percent for the mainland in Portugal; however, lower rates apply in Madeira and Azores at 4 percent.

Other taxes and obligations

Other taxes and obligations

There are other taxes in Portugal to consider, which include:

- IMI (Annual Municipal Property Tax): Paid by all property owners, regardless of use.

- AIMI (Additional Municipal Property Tax): Levied on high-value properties (VPT over €600,000 for individuals).

- Tourist tax: Collected from guests (e.g., €4 per night, per person in Lisbon or €3 in Porto for guests over 13, for a maximum of 7 nights) and remitted monthly to the local.

The Challenges of Operating a Short-term Rental in Portugal

Investors can face a couple of risks and practical constraints when managing short-term rentals, such as:

- Condominium veto: Even though new owners no longer need prior approval from the condominium to register the AL, the neighbors have the power to stop the operation because of repeated disturbances, like noise, security issues, and improper use of common areas. So, it’s critical to have a good relationship with your neighbors.

- Capacity limits: The new cap limits an AL property to a maximum of nine bedrooms and 27 guests, which affects guesthouses and multi-unit buildings.

- Regulatory uncertainty: The Portugal short-term rental laws are often debated and changed by the government due to pressure on the housing market.

What are the best areas for short-term rentals in Portugal?

When looking for the top locations for short-term rentals, here are a couple of areas to consider:

When looking for the top locations for short-term rentals, here are a couple of areas to consider:

- Lisbon offers the highest nightly rates and stable income, but faces the most severe restrictions in central areas. The area is in high demand from expats, digital nomads, and tourists.

- Porto provides very close occupancy rates to Lisbon and more affordable property prices. There are fewer regulatory restrictions and a slightly better initial return, especially when investing near the Porto beach, such as those in Matosinhos or Vila Nova de Gaia.

- The Algarve is a popular tourist destination with coastal towns offering high occupancy during the peak summer season, especially for large luxury villas and modern apartments.

- The Silver Coast offers lower entry prices for coastal properties compared to Lisbon or the Algarve. Investors can acquire larger homes, plots of land, or apartments with a lower initial capital outlay.

- Rural areas are an excellent choice for cheap short-term rentals in Portugal. Investors can buy renovated farmhouses or village homes and market them for rural tourism (Turismo em Espaço Rural), which can provide attractive yields due to stunning mountain views or charming countryside.

Goldcrest: How we can help you?

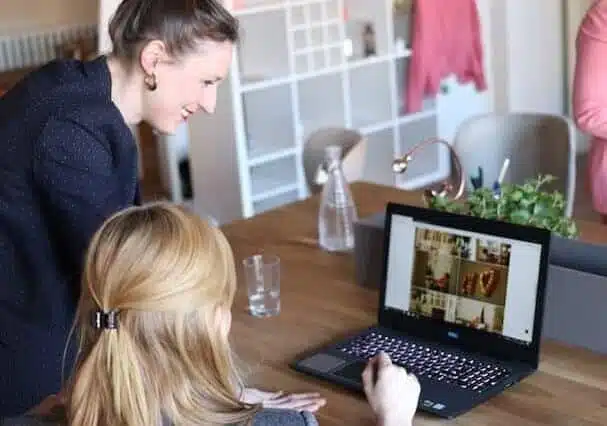

Major cities, such as Lisbon and Porto, and coastal areas in the Algarve, are in high demand for both short-term and long-term rentals, vacation properties, homes, villas, and apartments. If you are looking to buy property, a buyer’s agent provides expert insight into the Portuguese real estate market.

Goldcrest offers a team of buyer’s agents to source off-market properties and negotiate prices across the real estate market. With professional property management services, we make sure your investment continues to run smoothly, whether you live locally or abroad.

Our team can connect you with local experts, such as real estate lawyers, contractors, and tax advisors. Contact us today to make the most of your investment.

Frequently Asked Questions about Portugal Short-Term Rentals

Are short-term rentals in Portugal worth it?

Yes, Portugal’s short-term rentals are profitable in 2025, but success ultimately depends on location, effective management, and following the latest regulations.

What is the Portugal short-term rental news?

Portugal’s government recently rolled back national restrictions on new short-term rental licenses, making them generally transferable and permanent again. However, municipalities now have more power to impose strict local limits in containment areas to manage housing shortages.

Do I need an AL license to Airbnb my apartment in Portugal?

Yes, in most cases, you need an Alojamento Local (AL) license to rent out your apartment on Airbnb in Portugal legally.

Can foreigners invest in short-term rentals in Portugal?

Yes, foreigners can buy property in Portugal without restriction, including short-term rentals. You will need a Portuguese tax number (NIF) and register the property to comply with local short-term rental regulations.

How much to rent an apartment in Portugal for a month?

According to Numbeo, the average cost for a one-bedroom apartment in the city center is €911 per month or €721 per month outside of central areas in Portugal.