Updated: February 2, 2026

The Lisbon real estate investment market offers an excellent return on investment, thanks to its high rental yields and a strong economy. With an average price of €6,934 per square meter, Lisbon properties remain more affordable than those in other Western European capitals, such as London and Paris.

Lisbon’s property market isn’t heading for an imminent bubble. Instead, property prices are steadily increasing, while the demand is growing. Expats and investors are drawn to the high quality of life, good safety standards, and large expat communities.

However, since Portugal implemented strict policies for short-term rentals, investors have had to take a more strategic approach. In this Lisbon real estate guide, we have compiled the latest data on investment potential, strategies, and the top neighborhoods that offer the most lucrative gains.

Stick around to read about:

Key Aspects of Buying Real Estate in Lisbon

- Buying real estate in Lisbon is an excellent investment opportunity for foreigners. Portugal's real estate market is more affordable than some other countries, such as the United Kingdom, France, Germany, and the United States.

- Investors can benefit from the lower cost of living, high quality of life, from 5.2 to 6.8 percent rental yields, and various residency options.

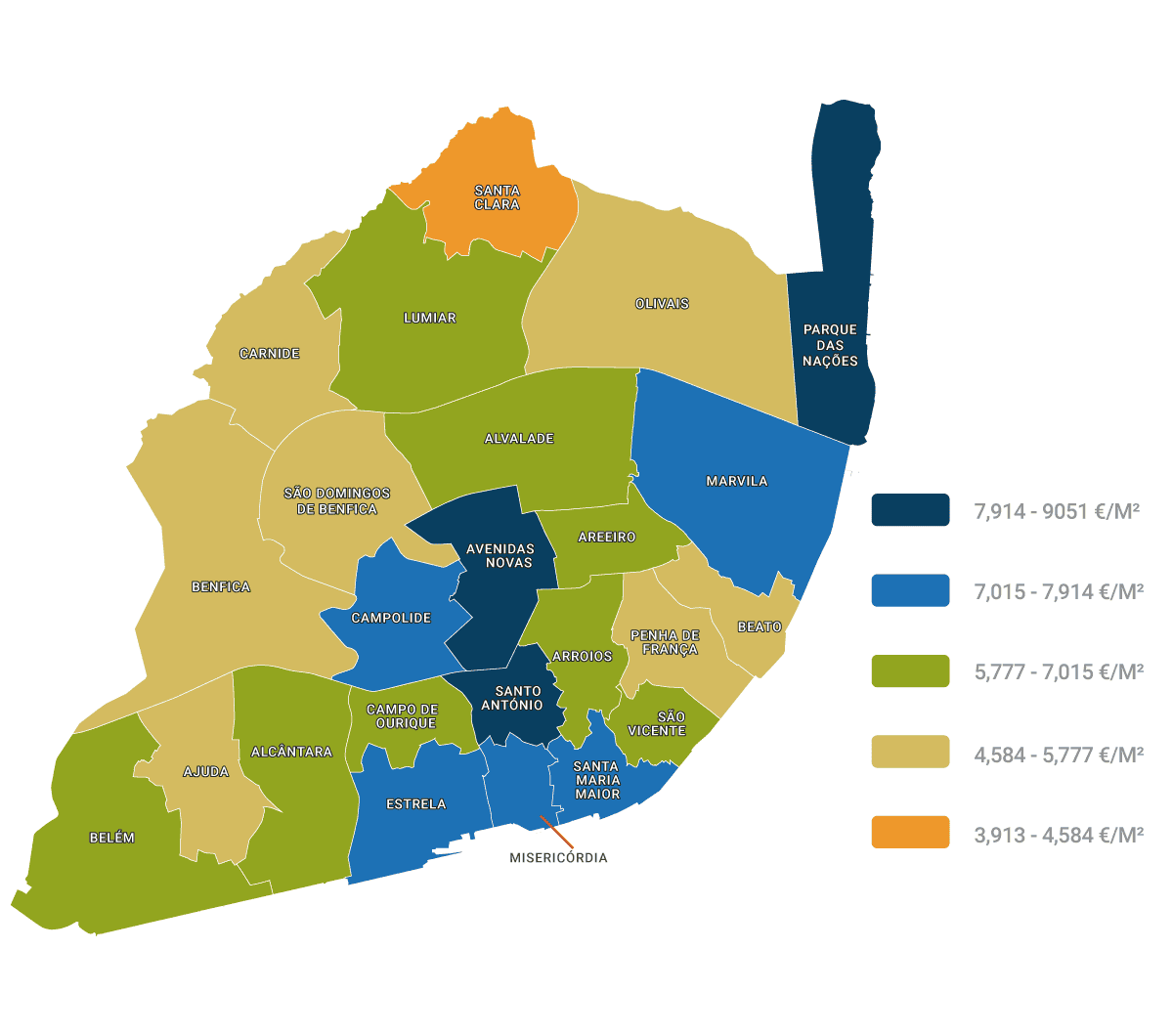

- Average real estate prices in Lisbon are about €6,934 per square meter, or €4,935 in the Metropolitan Area. And the best neighborhoods/parishes for real estate investments are Baixa, Príncipe Real, Alfama, and Graça.

- Portugal has no restrictions on foreign property ownership, so foreigners can easily invest in real estate. But, they first need a Portuguese NIF number, since it is a basic requirement for opening a local bank account, securing financing, or signing any official purchase document.

Is Lisbon a good place to invest in real estate?

Yes, the Lisbon real estate market is a great place to invest, due to its booming tourism, strong apartment demand, and limited supply in prime districts. Portugal has no restrictions on foreign property ownership.

However, investing strategies in Lisbon have evolved. The city once attracted buyers seeking high-yield short-term rentals. In 2025, the strongest opportunities lie in long-term capital appreciation, urban regeneration areas, and niche segments. These markets offer investors more stable and predictable returns.

Here is a detailed analysis of the advantages of real estate investment in Lisbon.

Growing real estate market

Growing real estate market

The Lisbon real estate market has a strong investment potential due to its steady growth. Property prices in Lisbon went up by 0.5 percent in the first quarter of 2024. The municipality of Lisboa recorded the highest house prices based on Statistics Portugal.

According to Eurostat, Portugal experienced a year-on-year (YoY) increase in house prices of 17.2 percent in the second quarter of 2025. This data shows the highest rate among all European Union member states.

Lisbon is the most expensive real estate market in Portugal. The average listing price is €6,934 per square meter, or €4,935 in the Metropolitan Area. Although average house prices have more than doubled in the last decade, they remain more affordable than in many other Western European capitals, such as London and Paris.

Good rental yields

Good rental yields

The explosive growth in Lisbon rents is over. After a staggering 30 percent increase in 2023, the rental market showed steady growth of 2.8 percent in the second half of 2024. Overall, rents for 2024 finished 10.5 percent higher than they were in 2023.

The average rental yield in the Lisbon Metropolitan Area is 6.8 percent, while in Lisbon City it is 5.2 percent, compared to higher yields in Setúbal (7.3 percent) and Barreiro (7.8 percent).

Still, Lisbon is one of the most profitable cities in Europe for buying and renting properties.

Strong capital appreciation

Strong capital appreciation

The market outlook for Lisbon in 2025 is positive, with real estate prices expected to appreciate by 7 percent to 10 percent in Greater Lisbon. This rate represents a continued but more moderate growth trend expected to last through 2026.

The Lisbon luxury property market is leading the way. Portugal’s capital took fourth place among European cities with the most significant potential for appreciation in the luxury market in 2025.

According to Knight Frank‘s report “2025 European Prime Price Forecast,” the prices of luxury homes in Lisbon are expected to grow by 4.5 percent in 2025, surpassing those of cities such as Milan, Geneva, Paris, and Monaco.

Overall, Portuguese real estate is a profitable investment with long-term value, particularly in areas near the coast or Lisbon’s city center.

Safety and a stable economy

Safety and a stable economy

According to the Global Peace Index in 2025, Portugal is the seventh safest country in the world, making it one of the safest places to live. Lisbon offers low crime rates, a high standard of living, and a welcoming atmosphere with friendly locals.

The Lisbon real estate market is the heart of Portugal’s growing economy, which benefits from strong tourism, foreign investment, and a booming digital and tech sector.

The Lisboa Metropolitan Area (LMA) accounts for 36 percent of Portugal’s gross domestic product (GDP). In 2022, the country’s GDP increased by 6.8 percent, with Lisbon, the Algarve, and Madeira experiencing the highest growth rates, according to Statistics Portugal.

Investing in Portuguese real estate is further enhanced by its over 300 days of sunshine annually and no restrictions on foreign property ownership, which attracts many international buyers.

Growing startup hub

Growing startup hub

Lisbon is one of Europe’s fastest-growing startup hubs. Funding for startups has increased by approximately 30 percent annually since 2016.

Portugal has also introduced a series of pro-business reforms. It allows companies to register in under 48 hours and offers a €200 million support fund, as well as tax incentives, including a corporate tax rate of 20 percent.

The Web Summit also moved from Dublin to Lisbon in 2016 and will stay until at least 2028. Its presence has boosted global attention and strengthened international ties within the local tech scene.

Infrastructure and peripheral development

Infrastructure and peripheral development

Many real estate investors are shifting their focus from the expensive and crowded Lisbon center to the neighborhoods just outside of it. There are many things to do in Lisbon and cheaper properties to buy in the peripheral areas.

The city is building new subway lines, like the Metro’s Circular Line and the Red Line extension to Alcântara. Buying real estate near new stations, such as Estrela and Santos, is likely to increase its value. Old, rundown industrial areas like Marvila and Beato are being completely rebuilt and modernized because the new transport links make them desirable.

The Portuguese government offers tax incentives, such as a 6 percent VAT (Value Added Tax) reduced rate on renovations in Urban Rehabilitation Areas, making residential properties in these developing zones popular for long-term capital appreciation.

Large expat community

Large expat community

Lisbon has a large and welcoming expat population. There are thousands of international residents from countries such as the US, UK, France, Germany, and Brazil. The city offers a range of expat-friendly amenities, including international schools, family-friendly properties, coworking spaces, and networking events.

With Lisbon’s aging population (the average age is currently 45 years), there’s an increasing need for properties designed for older residents, including accessibility features and proximity to healthcare services. This demand will, in turn, boost foreign investment in retirement homes in Lisbon, Portugal.

Low cost of living

Low cost of living

The cost of living in Lisbon is relatively affordable compared to many other parts of the European Union.

According to Numbeo, consumer prices in Lisbon are:

- 31.4 percent lower than in Paris

- 37.6 percent lower than in London

- 23.1 percent lower than Berlin

- 9.0 percent lower than Madrid

Real estate, transportation, groceries, and utilities are significantly more affordable than in the United States. For example, consumer prices in Lisbon are 47.0 percent cheaper than in New York, without including rent.

Where to invest in Lisbon's real estate for foreigners?

If you’re looking to purchase real estate in Lisbon, there is something for every buyer, whether you’re seeking a second home, a place to relocate with your family, or a more affordable purchase price.

Here are some of the best Lisbon real estate investment options.

Baixa

Baixa

Baixa is Lisbon’s historic downtown area, located in the civil parish of Santa Maria Maior. Baixa is well known for its vibrant streets, historic buildings, and bustling atmosphere. Investing in Baixa offers the advantage of a prime location with high tourist footfall. The neighborhood attracts tourists, locals, and new property owners, making it a favorable area for businesses like retail shops, restaurants, and accommodations.

Alfama and Graça

Alfama and Graça

Alfama and Graça are charming, traditional neighborhoods with narrow streets, Fado music, and stunning city views. These areas have seen increased interest from tourists and real estate buyers. They have an attractive short-term rental market for holiday rentals and vacation homes.

The unique ambiance and cultural heritage of Alfama and Graça contribute to their investment potential. Alfama is in the Santa Maria Maior neighborhood, while Graça is in São Vicente parish, providing slightly more affordable housing based on the property type.

Príncipe Real

Príncipe Real

Príncipe Real (Santo António parish) is an upscale neighborhood known for its elegant architecture, trendy shops, and pleasant gardens. It has become a hub for boutique stores, design shops, and upscale dining establishments.

Investing in Príncipe Real offers the opportunity to target a more affluent market and benefit from the neighborhood’s evolving reputation as a fashionable and desirable location.

Avenidas Novas

Avenidas Novas

Avenidas Novas is a residential and commercial district characterized by wide avenues, a mix of modern and historic buildings, and various amenities. This neighborhood has excellent property value. It is popular among young professionals and families due to its central location, affordable transaction costs, and proximity to educational institutions and services. Investing in Avenidas Novas can provide stable rental income and potential capital appreciation.

Parque das Nações

Parque das Nações

Parque das Nações is a modern waterfront district developed for the 1998 World Expo. It features contemporary architecture, a marina, gardens, and various leisure facilities. The area has experienced significant urban regeneration and is attracting tourists, business travelers, residents, and young professionals alike.

Lapa and Santos

Lapa and Santos

Lapa and Santos are adjacent neighborhoods known for their elegant mansions, art galleries, and vibrant nightlife. These areas attract a mix of young professionals, artists, and expatriates.

Investing in Lapa and Santos can involve renovating historic properties into luxury apartments or boutique hotels, capitalizing on the neighborhoods’ upscale image and cultural appeal. If you are looking to buy property to rent out long-term, then Lapa and Santos could be good options. Lapa and Santos are in the parish of Estrela.

Campo de Ourique

Campo de Ourique

Campo de Ourique is a residential neighborhood with a village-like atmosphere. It offers a range of amenities, including local markets, charming cafes, and tranquil streets.

Investing in Campo de Ourique can be advantageous for residential real estate and small businesses targeting the local community. The neighborhood’s authenticity and quality of life attract residents seeking a more peaceful and family-friendly environment. There are also many green parks here, adding to its appeal to families.

Marvila

Marvila

Marvila is an emerging neighborhood with a thriving creative scene and a growing number of art studios, galleries, and trendy venues. The area is undergoing urban revitalization, attracting young entrepreneurs and artists.

Investing in Marvila can involve converting industrial spaces into artistic or commercial ventures, taking advantage of the neighborhood’s evolving reputation and potential for future growth. Over the next 10 years, around €3 billion will be invested in Marvila real estate, making it one of Lisbon’s biggest regeneration projects.

Ajuda

Ajuda

Ajuda is a neighborhood located near Belém and known for its historic sites, including the Ajuda National Palace and the Botanical Garden. It offers a mix of residential areas and tourist attractions.

Investing in Ajuda can involve short-term rentals, guesthouses, or small businesses catering to tourists visiting nearby landmarks, benefiting from the neighborhood’s historical and cultural significance.

Outside Lisbon: Belém, Sintra, Cascais, and Oeiras

Outside Lisbon: Belém, Sintra, Cascais, and Oeiras

Investing outside Lisbon provides investors with an array of benefits. Some of the most lucrative options include Belém, Sintra, Cascais, and Oeiras. Belem boasts historical landmarks and a high footfall of tourists, while Sintra is a UNESCO World Heritage site, attracting tourists and offering investment potential in hospitality.

Cascais offers luxury properties on the Lisbon Coast and a thriving international community. At the same time, Oeiras is a well-connected business hub with tech companies and a desirable residential area near Lisbon.

Best Property Types to Invest in Portugal

The best type of real estate to invest in Portugal depends on your goals and investment strategy. Real estate with the highest rental yields is often available for those who prefer cash flow and actively manage their investments. While properties such as prime central apartments and luxury coastal villas can offer capital preservation and appreciation.

The table below provides a general outline of the expected returns in Lisbon, categorized by investment type.

Investment type | Strategy | Expected returns |

Residential apartments (buy-to-let) | Stable long-term rental | 4 to 7 percent annual yield |

Urban renovation projects | Aggressive capital flip | 20 to 35 percent total profit margin (on sale) |

Coastal villas or holiday homes | Short-term rental income | 10 to 14 percent peak season yield |

Luxury apartments or villas | Capital preservation | Premium rental rates + capital appreciation |

Purpose-Built Student Accommodation (PBSA) | High yield, high occupancy | 5.5 to 7 percent annual yield |

Lisbon Real Estate: Real Estate Prices and Investment Returns

Lisbon is the most expensive city in Portugal. But, despite the rising property prices, it remains a more affordable place to purchase real estate than other Western European capitals, such as London, Paris, or Amsterdam.

Average property prices in Lisbon

The average asking price for real estate in the Lisbon Metropolitan Area is €4,935 per square meter, while for Lisbon city, this rises to €6,934 per square meter.

The average asking price for real estate in the Lisbon Metropolitan Area is €4,935 per square meter, while for Lisbon city, this rises to €6,934 per square meter.

You can buy an apartment for €6,179 per square meter in the city center, or €3,986 per square meter outside the center.

You can find a cheap house for sale in neighborhoods like Olivais, Penha de França, Marvila, or Beato, with prices ranging from €3,500 to over €4,700 per square meter.

The price for luxury properties in Lisbon is over €12,000 per square meter, in neighborhoods such as Parque das Nações, Avenida da Liberdade, and Principe Real.

However, you can find more affordable high-end properties for €8,000 per square meter in areas nearby, like Oeiras, Estoril, or Cascais. You can read more about luxury properties in Portugal in our ultimate guide.

Rental yields in the Lisbon Metropolitan Area

While the average rental yield is 6.8 percent in the Lisbon Metropolitan Area, some areas offer better investment options than others.

Area | Rental Yields (%) |

Metropolitan Area Lisbon | 6.8 |

Lisbon City | 5.2 |

Cascais | 5.5 |

Loures | 6.3 |

Mafra | 6.4 |

Oeiras | 5.5 |

Sintra | 6.8 |

Vila Franca de Xira | 6.8 |

Amadora | 7.0 |

Odivelas | 6.0 |

Almada | 6.6 |

Barreiro | 7.8 |

Montijo | 6.4 |

Seixal | 7.0 |

Setúbal | 7.3 |

Lisbon Real Estate Investment Strategies and Opportunities 2025

Market indicators are showing a positive trend in Lisbon real estate foreign investment.

Market indicators are showing a positive trend in Lisbon real estate foreign investment.

In Portugal, foreign direct investment (FDI) increased by €13.2 billion in 2024, with €3.5 billion focused on real estate, based on reports from the Bank of Portugal.

There is a high demand for real estate investment in Lisbon, but a limited supply in areas such as Príncipe Real, Chiado, and Avenida da Liberdade.

The forecast for Lisbon’s luxury real estate in 2026 is exceptionally strong.

Experts believe that property prices in Lisbon are unlikely to drop. Instead, they are expected to increase from 10 percent to 15 percent in central areas by 2026.

As a result, the highest returns are now shifting from the Lisbon center to the more affordable outskirts.

Best Lisbon neighborhoods for real estate ROI

The ROI on Lisbon properties varies based on the type of property and neighborhood. The table below provides an overall outlook for real estate investment across various locations, along with the average real estate price per square meter.

Lisbon neighborhood | Average price/m² | Rental yield (%) |

Ajuda | €5,366 | 5.4 |

Benfica | €5,123 | 5.9 |

Campolide | €7,125 | 5.3 |

Lumiar | €5,785 | 5.2 |

Olivais | €5,697 | 5.9 |

Misericórdia | €7,895 | 5.0 |

Penha de França | €4,644 | 5.9 |

São Vicente | €6,401 | 5.0 |

Avenidas Novas | €8,377 | 4.9 |

Campo do Ourique | €6,974 | 4.9 |

Estrela | €7,694 | 4.4 |

Parque das Nações | €8,517 | 4.6 |

How to invest in Lisbon's real estate as a foreigner?

If you are looking to make a real estate investment in Portugal, the buying process can be divided into five steps.

Step 1: Get a NIF

Every non-resident and resident needs a Portuguese tax identification number (NIF). This is a nine-digit number that you will use to pay taxes, sign documents, and open a local bank account.

You can apply for a NIF in Portugal at a local tax office, Citizen Shop, or assign a fiscal representative to apply on your behalf if you live outside the country.

Step 2: Find the perfect property

When starting your search for real estate, you can work with a buyer’s agent or a real estate agent in Lisbon. They can understand the market and provide valuable insights into high-demand areas. While online listings can be a great starting point, many of the best deals are found through local connections and exclusive databases only real estate professionals can provide.

Step 3: Negotiation

Once you’ve found the right property, the negotiation phase begins. Unlike in some countries, price negotiations in Portugal are common, and offers are often made below the asking price. A buyer’s agent can negotiate prices and find the best offer for your budget.

Step 4: Promissory contract (CPCV)

Once a price is agreed upon, both parties sign a promissory contract (Contrato de Promessa de Compra e Venda – CPCV). This legally binding agreement secures the purchase terms and typically requires a 10 to 20 percent deposit of the property price.

Understanding the legal implications of investing in real estate is crucial. We recommend working with an experienced real estate lawyer in Lisbon. With some additional legal fees, the lawyer can guide you through the legal processes and due diligence checks.

Step 5: Sign the final deed

The final step is signing the final deed (Escritura), which officially transfers ownership to the buyer. You do it at a notary’s office, where both parties sign the deed. Finally, you can register the property in your name at the Portuguese Land Registry.

Maintaining Your Real Estate in Lisbon

To maintain your real estate in Lisbon and ensure it is in good condition, you need to comply with legal regulations, perform regular maintenance, and plan for additional expenses.

To maintain your real estate in Lisbon and ensure it is in good condition, you need to comply with legal regulations, perform regular maintenance, and plan for additional expenses.

If you own an apartment, you are required to pay condominium fees (Quota de Condomínio) regardless of whether you reside there. These are maintenance fees for the roof, elevators, façade, halls, gardens, and general insurance.

Older properties require more frequent maintenance, including regular checks for humidity, leaks, and outdated wiring, as well as window replacements. While newer buildings mainly need yearly air conditioning and ventilation checks.

It’s a good idea to have a backup plan for unexpected repairs and to consider extensive insurance coverage, especially if the real estate you own requires renovation.

For any property that is sold or rented out, you must register with the tax office (Finanças) and get an energy certificate (Certificado Energético).

If you are working with short-term rentals, like holiday lets via Airbnb or Booking.com, you will need an AL (Alojamento Local) license.

You can also hire a property manager if you don’t live in Portugal and want to rent out your asset. A buyer’s agent like Goldcrest offers property management services for long-term rentals.

Property owners pay both transaction costs and ongoing taxes. They are subject to IMT (Municipal Property Transfer Tax) and Stamp Duty at the time of purchase. They are also subject to IMI (Annual Municipal Property Tax) each year, and for higher-value properties, they pay AIMI (Additional Municipal Property Tax). You can read more about property taxes in Portugal in our comprehensive guide.

Challenges of Real Estate Investments in Lisbon, Portugal

Although the Lisbon real estate market is highly attractive, foreign investors may face a couple of challenges that can impact their investment strategy.

Rental restrictions

Rental restrictions

Most of central Lisbon (including areas like Baixa, Alfama, Bairro Alto, and parts of Avenidas Novas) has been designated a Containment Zone. In these Containment Zones, the Lisbon City Council has banned the issuance of new Alojamento Local (AL) licenses, which are necessary for working with rental properties.

Even if a new license is permitted in a peripheral zone, the Condominium Assembly (homeowners’ association) in a building now has the power to vote by a two-thirds majority to revoke or oppose the AL license.

Investors focused on short-term rentals must now either buy properties with existing, transferable licenses or shift their focus entirely to mid-term or long-term rentals in these central areas.

Golden Visa exclusion

Golden Visa exclusion

As of October 2023 (under the Mais Habitação), all real estate investment options, such as residential, commercial, and rehabilitation projects, were removed from the Portugal Golden Visa program.

This means you can no longer obtain the Golden Visa (residency by investment) by investing in real estate in Lisbon or anywhere else in Portugal.

The Golden Visa Portugal is still an option, but investors must now pursue other routes, such as investing in commercial real estate, hotels, or qualifying investment funds (Venture Capital).

Higher entry points

Higher entry points

Because Lisbon’s property prices are high compared to local wages, investors face higher entry points for real estate investments.

Non-resident foreign buyers often require a higher down payment of 20 to 40 percent. Although international investors can obtain a mortgage in Portugal, they face slightly stricter criteria than residents and Portuguese citizens.

Supply constraints

Supply constraints

Lisbon, especially in the coastal area, faces a high demand from both local and international buyers. Since this is a densely populated coastal city, there is not much empty land left to build within the city limits.

Obtaining Residence and Citizenship Through Portugal Investing

Even though Portugal’s Golden Visa program has ended its real estate investment option, buying real estate in Lisbon is still a smart investment. If your goal is residency or citizenship, there are many other paths to consider, including other investment options in the Portugal Golden Visa program.

Even though Portugal’s Golden Visa program has ended its real estate investment option, buying real estate in Lisbon is still a smart investment. If your goal is residency or citizenship, there are many other paths to consider, including other investment options in the Portugal Golden Visa program.

Non-EU citizens can also apply for a D7 Visa or D8 Visa, or investigate the family reunification, work, or study visas. After maintaining legal residence, you may be able to apply for permanent residency or citizenship, too.

If you want to obtain residence or citizenship in Portugal, speak to the expert team at Global Citizens Solutions. They can advise you based on your individual needs.

Goldcrest: How We Can Help You

Goldcrest is a buyer’s agent that is based in Lisbon. We provide expert, impartial advice on real estate investments and how to buy property in Portugal. From scouting out the perfect property through to property acquisition, we have you covered throughout the process.

If you are looking to purchase property in Portugal, don’t hesitate to get in touch. Our team of skilled experts is available to solve all your real estate doubts, helping you with the property search and offering insightful expertise and strategic advice.

Why choose Goldcrest?

- Local knowledge: With offices located across Portugal, our presence nationwide allows us to assist you personally across the country.

- Independent service: As an independent buying agent, we do not represent any development or project. Our service is entirely tailored toward each individual client, providing you with everything you need to secure the perfect property at the best possible price. As an impartial advisor on the market, we work solely on behalf of our client and provide a service tailored to your needs and requirements.

- Streamlined process: Our real estate agents speak English and Portuguese, and our service is completely focused on providing you with a hassle-free buying experience, saving you time.

- Experienced team: Our expert real estate team has a vast local knowledge of the Portuguese property market. We have cutting-edge technology and metasearch tools at your disposal to provide full market coverage, ensuring the best investment choices and negotiated prices.

- Network of partners: We have a close network of partners, including lawyers, property management services, builders, architects, designers, and landscape gardeners, again saving you time and hassle by providing you with trusted experts in their field of work.

Frequently Asked Questions about Lisbon Real Estate Investment

Is buying property in Lisbon a good investment?

Yes, buying property in Lisbon is a wise investment. Real estate investors can enjoy 6.8 average rental yields, strong capital appreciation, a high quality of life, and excellent safety standards.

What types of properties are available for investment in Lisbon?

There is a wide range of properties available in Lisbon, including apartments, villas with swimming pools, and houses. You will also find a selection of waterfront properties. The diverse range of properties available is one of the key advantages of buying in Lisbon.

Can a US citizen invest in real estate in Lisbon?

Yes, an American citizen can invest in real estate in Lisbon, as there are no restrictions on foreign property ownership. The process is straightforward, but you will need a Portuguese tax number (NIF) to complete the transaction. Hiring an independent lawyer can help navigate the legal process.

Where is the best place to invest in real estate in Lisbon, Portugal?

The best area will depend on what you are looking for. Foreigners invest in Baixa, Alfama, and Principe Real, which offer great opportunities, alongside up-and-coming areas such as Beato and Marvila.

What is the real estate investment outlook for Lisbon 2026?

The Lisbon real estate market in 2025 is positive, with many real estate investors seeking out the Portuguese capital. There is a spike in international demand, but limited supply in some locations like Príncipe Real, Lapa, and coastal areas. Prices are expected to rise, mainly in the luxury and suburban sectors. The rental market remains strong, making it a popular destination for capital appreciation and rental income.

What is the forecast for Lisbon luxury real estate market?

The forecast for Lisbon’s luxury real estate in 2025 is exceptionally strong. The average price per square meter in prime central districts, like Avenida da Liberdade and Príncipe Real, can exceed €12,000 per square meter.

What taxes apply to foreign real estate investors buying property in Lisbon?

When foreigners invest in real estate, they must pay property taxes. At the time of the purchase, you can pay Property Purchase Tax/ Property Transfer Tax (IMT) and Stamp Duty, while annual taxes include Municipal Property Tax (IMI). You should also consider the Capital Gains Tax if you sell real estate. If your Lisbon asset costs more than €600,000, you must pay AIMI (Addition to the Municipal Property Tax) each year, depending on the property value and how it’s held.

What documents do I need to buy Lisbon real estate?

To buy real estate in Lisbon, as a foreigner, you’ll need a Portuguese tax number (NIF), a valid ID, proof of tax payment, proof of funds, a promissory contract, and a mortgage contract if necessary.

Where is the best region to buy a rental property in Portugal?

Lisbon is ideal for tourism, urban, and corporate rentals. Porto and the Algarve are also great for tourism-driven short-term rentals. Up-and-coming areas like Setúbal and Comporta offer strong growth potential.

Where are cheap houses for sale in Lisbon, Portugal?

You can find cheaper houses in Lisbon outside the central area in Lisbon neighborhoods like Marvila, Olivais, and Penha de França. The Lisbon South Bay, including Setúbal and Barreiro, also provides significantly cheaper properties.

What are the risks and pitfalls of real estate investment in Portugal?

There are some downsides to investing in real estate in Portugal. These include hidden debts or property issues, legal complexities, fluctuating market trends, cultural and language barriers, and unexpected costs. Taking necessary precautions, like analyzing the real estate value or working with a buyer’s agent, can help you make an informed decision.

What is the average rental yield in Lisbon?

The Lisbon Metropolitan Area offers an average rental yield of 6.8 percent, compared to the 5.2 percent within the city itself. Beachfront properties, like Lisbon apartments and luxury properties with incredible views, can offer higher rental yields during the peak summer season.