Updated: June 20, 2025

Buying your dream home or finding a perfect investment property to rent out can be exciting. However, you may be concerned about financing options and whether you can get a mortgage in Portugal as a foreigner.

The mortgage application process may seem daunting, but you’ll be pleased to know that getting a mortgage in Portugal as a foreigner is a fairly straightforward process and there are no restrictions on buying a house in Portugal as a foreigner. With guidance and the right mortgage broker, you’re not likely to face any unmanageable difficulties during the process.

In this article, we will cover how to get a mortgage in Portugal and what to look for in your mortgage agreement. We will equip you with everything you need to know about financing your property in Portugal and mortgages in Portugal – from property and mortgage deeds to property tax.

Taking Out a Mortgage in Portugal: An Overview

With mortgage rates ranging from three to five percent based on a 70 percent loan to value ratio (ratio of the loan amount to the value of the property pledged as collateral), the loan terms and mortgage repayments are also quite affordable.

Why should I take out a Portuguese loan to buy property in Portugal?

Before wondering which mortgage is right for you or how to get a mortgage in Portugal, first consider whether purchasing property in Portugal is the right option for you. What does the real estate market offer? Is commercial or residential real estate more suitable? And is Portugal the right place for you?

Portugal is an excellent country to invest in, do business in, or live in. This Western European country is blessed with a high quality of life, a low cost of living, and sublime weather. With an excellent healthcare and education system, friendly locals, a stable economy, and a vibrant culture, Portugal has lots to offer. Whether you are moving with a family, retiring, looking for an opportunity to generate rental income, or simply looking for a lovely Mediterranean corner of the world to call home, then yes, Portugal is likely a great option to consider.

Can foreign buyers get a mortgage in Portugal?

Getting a mortgage in Portugal for foreigners is an easy enough process. International buyers will be happy to know that the process for mortgages in Portugal for non-residents is quite similar to residents, except for differences in some of the mortgage terms.

Whether you are a permanent resident, an expat, or investing in property from abroad, you are most likely to be offered a mortgage by a Portuguese lender if you have a good credit score and history, as well as a reliable income through stable employment, passive investment income, or business ownership.

Benefits of getting a mortgage in Portugal

Portugal prides itself on the way it welcomes visitors and investors, and you’ll easily find many options to secure a mortgage for a property in Portugal from various local banks with the help of an independent mortgage broker.

A mortgage is the most common way to finance your property purchase in Portugal. Some of the benefits of taking out a mortgage in Portugal are:

- There is increased interest from Portuguese mortgage lenders in assisting foreigners with lending solutions.

- The Portuguese mortgage lender will carry out legal checks.

- The lender will arrange for a valuation to take place.

- There are low mortgage rates in Portugal.

- Mortgages in Portugal for residents and foreigners are available in Portugal.

- In Portugal, properties purchased on credit can be rented out without restrictions, therefore reducing risks.

Before accepting a formal mortgage offer, it’s important to ensure that the property you are purchasing has gone through the proper checks. To do this, you may want to consider seeking the services of a Portugal real estate lawyer. You will require legal aid at various points throughout the process of purchasing a home in Portugal, so it can be helpful to have a reliable lawyer on your team from the start, particularly as they will be able to navigate the Portuguese language barrier if you are not familiar with Portuguese.

The services a real estate lawyer can provide include, but are not limited to:

- Overseeing the purchasing transaction from start to finish

- Remote handling of bureaucratic procedures

- Checking whether any outstanding debts are attached to the property

- Checking who the legal owner(s) is/are and that they have the right to sell the property

- Checking the construction history of the property (property valuation)

- Drawing up contracts and documents, such as the reservation agreement

- Reviewing the purchase and sale agreement and advising you on its legal consequences and obligations

- Requesting necessary legal documents for the property

- Providing Portuguese real estate legal advice about everything from mortgage repayments to having contract life insurance

Once you are confident that your chosen property is right for you, or even during your property search, you can move on to finding a mortgage. There are different mortgage options to choose from in Portugal, such as a fixed-rate mortgage or variable-rate mortgage. So, let’s have a more detailed look at what you need to know about mortgages in Portugal.

At what stage should I apply for a mortgage in Portugal?

Once you have made the decision to buy property in Portugal, it is best to start the mortgage process as early as possible – even before you start looking for the property you want to buy.

Starting the process early by reaching out to a mortgage broker to see what you can realistically afford will help you to accurately determine your budget before searching for the home you wish to purchase. It will also give you the upper hand in negotiations, showing you are a serious buyer.

Compare mortgages from different banks

Portugal has over 15 banks that provide mortgage loans, including BBVA, Santander, Banco Best, Millenium BCP, and Banco CTT, among other banks in Portugal. Depending on your unique circumstances and requirements, it’s a good idea to work with a mortgage broker to compare what a few of the banks will offer you before deciding on which bank to go with.

What types of mortgages are available in Portugal?

There are a few different mortgage loan options to choose from if you need to finance your property purchase in Portugal.

Fixed-rate mortgage

Fixed-rate mortgages allow property owners to pay a constant rate for a certain period. These mortgages are offered for anywhere between 3 and 30 years, with banks charging a significant premium for a fixed-rate mortgage. The advantage is that borrowers are generally protected against fluctuations in Euribor rates.

Currently, fixed-rate mortgages at some of the leading banks in Portugal are available at four to six percent (TAEG) for up to five years, based on loan-to-value (LTV) ratios of up to 70 percent. It is important to note that while LTV ratios can go up to 90 percent, non-fiscal residents are limited by regulation of up to 60 to 80 percent.

Variable-rate mortgage

Variable-rate mortgages are the most common option in Portugal, with rates usually beginning at 3.3 annually for a loan-to-value ratio of 30 percent.

Variable-rate mortgages depend on the mortgage spread – a fixed percentage of interest – offered by the bank you borrow from. Currently, the mortgage spread is sitting around one to two percent for the majority of financial institutions.

A variable-rate mortgage in Portugal for non-residents typically reaches 60 – 80 percent, so customers should budget to have around 20 to 40 percent of the purchase price within easy reach, plus the cost of taxes and fees on top of this. The monthly payments on a variable-rate mortgage fluctuate over time depending on the indexer (Euribor) and your variable-rate mortgage period, which can be between three, six, and 12 months. Over the repayment period, the monthly payments on variable-rate mortgages are usually revised. Also, you will have to pay a minimum fee on the repaid capital if you decide on early repayment.

Mixed-rate mortgage

This mortgage type combines a fixed period with a variable period, offering a balance of stability and potential cost savings.

What are the mortgage rates in Portugal?

Foreigners might face higher mortgage rates due to perceived risk, but competitive rates are available from select lenders.

Mortgage rates are currently fluctuating in Portugal. Fixed-rate mortgages typically range from 2.5 to 3.8 percent, while variable rates are between 2.3 and 3.2 percent. Mixed rates, which combine a fixed period with a variable rate, can range from 2.7 to 3.5 percent.

These rates can vary depending on the loan term and the borrower’s individual circumstances (borrower profile). Other factors influencing the mortgage rates include the Euribor rate, the European Central Bank’s interest rate decisions, bank lending policies,

Factors that can affect the mortgage rate

Mortgage rates in Portugal are influenced by the European Central Bank’s policies and the overall economic climate. The main factors influencing the rate you will receive include:

- The property price: The value of the property you would like to buy will influence your rate.

- The deposit size: The size of your down payment will influence the rate you are offered.

- Financial history: Your credit history is a significant influencing factor.

- The mortgage type: You will be offered a different rate depending on whether you opt for a fixed or variable-rate mortgage.

- The current Euribor rate

Mortgages in Portugal for retirees

As a retiree in Portugal, you can get a mortgage, provided you have a regular pension income. Note that while banks do offer mortgages to retirees, most banks will not offer a mortgage to individuals who are over 70 years old. Some, however, will extend this limit to 80.

Additionally, the maximum lending age in Portugal for a non-resident is restricted to 75 years of age, with a limit of 360 months for the maximum mortgage period. Something else to bear in mind is that life insurance is a standard loan requirement, and if you are over 60 years old, getting life insurance in Portugal at this age can be fairly difficult.

Mortgages in Portugal for businesses

Suppose the property you intend to buy is for commercial use. In that case, the maximum mortgage is usually 50 percent of the purchase price (or, if lower, the valuation is stated in the valuation report).

How much do I need to deposit?

- For a Portuguese mortgage, the minimum deposit is usually about 20-40 percent of the purchase price for non-residents.

- Financing institutions provide between 60 and 80 percent of the valuation price for non-residents.

Mortgage Conditions

As to be expected, there are basic conditions to consider when taking out a foreign investor mortgage in Portugal. These include the interest rate based on the Euribor, the term of the mortgage (usually 25-30 years), the lending criteria, and the requirement to contract life insurance or home insurance.

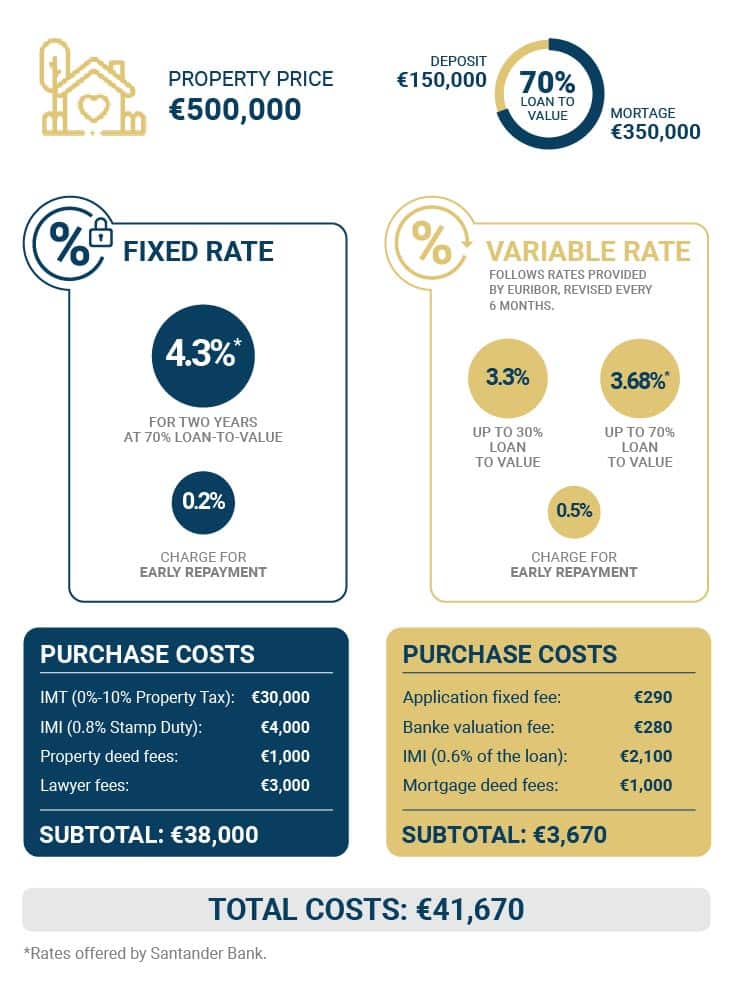

Costs and fees for mortgages in Portugal

Cost of purchasing a house in Portugal

In addition to the purchase price of the property, it is useful to be aware of the additional costs of purchasing a house in Portugal. These include:

- Property tax (IMT): 0 to 10 percent, depending on the purchase price, the location of the property, and whether it is your first or second home in Portugal

- Stamp Duty Tax (IMI): 0.8 percent of the price of the property

- Notary, registry, and tax office fees for property deeds: €500 – €1,000 + €250 for Land Registry

- Legal fees: Around €2,000 to €5,000

Cost of taking out a mortgage in Portugal

- €290 application fixed fee

- €280 bank valuation fixed fee

- Stamp Duty Tax (IMI): 0.6 percent of the amount of the mortgage

- Notary, registry, and tax office fees for property deeds: €500 – €1,000 + €250 for Land Registry

Property prices

Buying a property in Portugal is affordable when compared with other Western European countries. The housing market has moved from strength to strength in recent years and is an attractive market for both foreign investors and homebuyers.

In 2024, the average asking price for a house in the Lisbon Metropolitan Area, property prices stood at €4,935 per square meter and €6,934 per square meter in Lisbon city center. House prices will vary, however, depending on the type of property you are looking to purchase. It is also important to keep in mind that luxury properties in Portugal will be more expensive.

Compared with other Western European countries, you should also find prices to generally be quite reasonable. Note that popular areas, such as buying property Lisbon or buying property in the Algarve, will be more expensive than other parts of the country. If you are looking to buy and then generate rental income, then a real estate investment in Portugal can be very lucrative.

Also, it’s worth being aware that the purchase price can be higher or lower than the asking price, although it is normally lower. This difference between the purchase price and sales price is because sellers often look to sell their properties by a set date and are often constrained by other variables.

At present, Portugal’s highly skilled workforce, booming tourism industry, world-class infrastructure, business-friendly environment, and easy access to markets are among several factors that have contributed to a continuous and steady flow of investments into different economic sectors over the past few years.

Useful Terminology and Acronyms

TAN – Taxa Anual Nominal, the TAN is commonly known in English as the Annual Percentage Rate (APR). The variable TAN is the sum of the spread and the indexing rate, which is usually Euribor, for 12 months.

Euribor – The Euro Interbank Offered Rate is a daily reference rate based on the average interest rates at which Eurozone banks offer to lend to other banks in the euro wholesale money market (also known as the interbank market). You can see the 12-month Euribor Rate online.

TAEG – Taxa Annual de Encargos Efetiva Global is the sum of TAN and other lender costs, such as origination fees, required insurance, and so on. This rate is effectively used to compare similar mortgage loan options from different banks.

How to Apply for a Mortgage: A Step-by-Step Guide

The application process begins with an initial approach to the bank or mortgage broker. Having an experienced mortgage agent on your side will make securing the best deal for your situation much simpler.

They will proceed to supply you with a no-obligation estimate or preliminary analysis. This is often done at the branch level. It is important to have a documentation copy ready for the banker or mortgage agent to analyze and give you feedback.

A six-step process is then laid out, from getting a quote to signing the property deeds and mortgage deeds:

- Mortgage quote

- Application forms delivery

- Formal mortgage offer

- Valuation report

- Completion arrangements

- Payment (all the associated mortgage-related fees, minimum deposit, tax office fees, and taxes) and signing (property deeds and mortgage deeds)

Mortgage-related fees can include:

- Property and mortgage deeds registration

- Mortgage arrangement and administration

- Non-refundable commitment fee

- Survey and appraisal

- Legal fees

Work out the mortgage rates

The cost of the mortgage loan depends on the applicant’s financial status. The mortgage lender will measure your ability to maintain the loan. The spread or interest loans that the bank charges are a measure of the bank’s valuation of risk.

In Portugal, the interest rate charged is generally Euribor, plus the spread. This adds to the spread charged by the banks, which is currently one to two percent.

Mortgage agents will often approach various banks in Portugal. The goal is to secure the most competitive rates for you.

How to pick the right Portuguese bank for your mortgage

Many people will focus on the pricing of a mortgage facility. Yet, there are other important factors to consider:

- Some banks have a mandatory life insurance obligation that adds to the cost of a mortgage. It is usually best to avoid it for many non-residents.

- Some mortgage lenders may have more competitive interest rates but a cap on how much you can borrow.

- Some banks may offer variable-rate mortgages only, not fixed-rate products.

- Different banks will have different requirements when analyzing how much you can pay for a given loan amount.

- Some banks will emphasize certain types of income streams more than others.

- Some banks may not consider renting.

- Some banks will respond differently to income value.

This illustrates that some profiles are better suited than others for certain banks when it comes to getting formal mortgage approval.

The important factor is to make sure that your information is carefully examined and that, whenever possible, you are given several suggestions that may work for you before deciding on the one to go for.

Documents required to get a Portuguese mortgage

If you are going to apply for a mortgage in Portugal, you have to submit the following documents for your initial assessment:

- Copy of passport

- Portuguese tax number (also called a NIF number)

- Proof of income

- Bank statements

- A recent utility bill

- Recent mortgage statements

- Proof of any savings or investment income accounts

- Bank reference letters

- Property details – buying commitment or sales contract

These documents vary depending on your employment status. You should include the length of time that you have been in the company/employed/self-employed and demonstrate your gross annual salary.

If employed:

- The previous year’s income tax returns

- Salary income, as shown through the past three months’ pay slips

- Reference letter from employer

If self-employed (hold a 20 percent or more share in a limited company):

- Last year’s income tax return

- Last three months of business bank statements

- Three years of company profit and loss statements and balance sheets

Other income:

- Confirmation of pension income for the last three months

- Copy of tenancy agreement for rental properties

- The last three months of bank statements showing rent received

- Copy of investment certificates

Please note that the bank may request more documents.

Practical Information to Know about Mortgages in Portugal

In addition to the application process and the costs involved, here’s some other practical information to know about the maximum loan-to-value and the lending criteria for a mortgage in Portugal.

What is the maximum loan-to-value for Portuguese mortgages?

The maximum loan-to-value for Portuguese mortgages for non-residents is between 60 percent and 80 percent of the property’s purchase price.

What are the lending criteria for a mortgage in Portugal?

Portuguese banks will consider the applicant’s ability to pay the mortgage for the full term in the application process. To establish the loan’s affordability, the bank will apply a simple outgoings-to-income calculation.

The monthly outgoings, including the new mortgage payment, will be subtracted from the applicant’s total monthly income. The total monthly outgoings should never exceed 30 to 35 percent of the net monthly income, meaning that your monthly debt payments and living expenses should not exceed 35 percent of your monthly income after deductions. This is a very simplified description of how the bank reaches its decision. Always consult the bank or your agent for a more accurate assessment.

Competitive mortgage rates in Portugal: A key attraction for Americans

Portugal has some of the most attractive mortgage rates in Europe, especially when compared with the USA. Portuguese mortgage rates currently range from between 2.5 and 3.9 percent, depending on the loan type and the applicant profile. In the USA, mortgage rates often surpass 7 percent, making the cost of borrowing much higher.

What is the mortgage in Portugal calculator?

Portuguese lenders, like many banks and credit unions offering mortgage products in Portugal, will have their own mortgage calculator on their websites. These mortgage calculators calculate an estimated monthly mortgage repayment on Portugal mortgage rates for foreigners. Some Portuguese lenders may also offer first-time home buyer programs or incentives. Based on the property value, consider all the financial aspects related to the mortgage rates in Portugal in 2025, including your net borrowing, mortgage insurance, property tax, and the list of financial considerations pertaining to the mortgage application process below:

- Your credit score: An analysis of your credit files used to determine your creditworthiness

- Debt to income ratio: Your monthly debt payments and dividing it by your gross monthly income

- Loan to value ratio (LTV): The ratio of the loan amount compared to the property value

- Amortization Schedule: The breakdown of mortgage payments over time, including interest rate

- Insurance: Property insurance and mortgage life insurance requirements for securing a mortgage

- Early repayment charges: If the mortgage is paid off early, you will be charged a small fee. You will also be taxed on repaid capital should you decide to sell the property.

Key Takeaways: Getting a Mortgage in Portugal

Navigating mortgages in Portugal requires attention to detail and invaluable local knowledge and support. When getting a mortgage as a foreigner buying property, understanding the terms, interest rate, and impact on your financial position is crucial. Here, we summarize the key takeaways of applying for a mortgage for property in Portugal, including considerations to keep in mind that will make your venture into the Portuguese real estate market a seamless and rewarding experience. You can also read our e-book about buying property in Portugal for a full overview of the buying process.

The costs of a mortgage in Portugal

Securing home loans involves various costs. Expect to pay around 1 to 2 percent of the loan amount in arrangement fees, coupled with administration fees, valuation fees, and insurance costs. Additionally, property acquisition entails taxes like IMT (usually ranging from 0 percent to 10 percent), stamp duty tax (0.8 percent), notary, registry, and legal fees.

Applying for a mortgage in Portugal as a foreigner

Foreigners investing in Portuguese property will be required to meet specific conditions, which typically entail a larger initial payment, often around 20 to 40 percent of the property’s price, compared to Portuguese residents.

How mortgages work in Portugal

Mortgages in Portugal usually feature fixed interest rates for the loan’s entirety, commonly set between 25 to 30 years. The base rate is Euribor, onto which banks add their margins.

Qualifying mortgage requirements in Portugal

Eligibility for a mortgage in Portugal requires a solid credit history, stable income, and the ability to manage monthly payments. Lending criteria consider financial standings encompassing income, debts, employment history, and property valuation.

Compare banks for the best mortgage rate

To secure the best mortgage rate, it’s crucial to compare rates from various lenders. Institutions like BBVA, Santander, Banco Best, Bankinter, and Banco CTT offer diverse mortgage loans.

Bank | Variable Interest Rates |

BBVA | 4.51 percent plus 1.99 percent nominal interest rate (NIR) in the first year, followed by Euribor plus 1.6 percent after the first year |

Santander | 1.84 percent for the first six months, followed by Euribor, plus 1.84 percent NIR from the seventh month onwards. |

Banco Best | 5.5 percent, followed by 3 percent Euribor for 6 months and a spread of 1.9 percent. |

Bankinter | 4.71 percent in the first year, followed by Euribor plus 2 percent in the remaining years, although discounted rates are available if you meet certain conditions. |

Banco CTT | 4.3 percent, followed by a 3.7 percent Euribor plus a spread of 1.3 percent. |

The length period of mortgages in Portugal

The most common mortgage term in Portugal is 30 years, although flexibility exists for shorter or longer durations.

The down payment on a house in Portugal

The minimum down payment for foreigners is usually 20-40 percent of the purchase price, though some lenders may require up to 50 percent.

The qualifying age limit for a mortgage in Portugal

The minimum age limit is 18 to apply for a mortgage. However, there isn’t an official age limit. Borrowers above 70 might encounter hurdles in securing loans because mortgages for non-residents typically span 25 to 30 years.

Goldcrest: Property Specialists to Help You Find Your Dream Property

Goldcrest is a buyer’s agent that is based in Lisbon, Porto, and the Algarve. Equipped with local knowledge, exclusive networks, and international experience, we provide expert, impartial advice on real estate investments and how to buy property in Portugal.

From scouting out the perfect property through to property acquisition, we have you covered throughout the process. Our team of skilled experts is available to cater to all your real estate needs, offering insightful expertise and strategic advice. Book a complimentary call with us today.

Frequently Asked Questions About Getting a Mortgage in Portugal

What types of mortgages are available in Portugal?

In Portugal, homebuyers can choose between fixed-rate and variable-rate mortgages. Fixed-rate offers stability for a set period (3-30 years) but comes at a premium. Variable rates are influenced by Euribor and the bank’s spread, offering potential savings but with fluctuation risk. Retirees with regular pension income may qualify, though age limits typically apply (around 70-80 years old). For commercial properties, the maximum mortgage is generally capped at 50 percent of the purchase price.

How to get a mortgage in Portugal?

Portuguese banks offer mortgages to residents and non-residents. If you do not have a fiscal representative or a buyer’s agent, you can approach a major Portuguese financial institution – such as Santander, Novo Banco, BBVA, EuroBic, or Bankinter – directly.

What are the benefits of taking out a Portuguese mortgage for foreigners?

The key benefit of taking out a Portuguese mortgage is that Portuguese mortgage lenders can offer valuable services and benefits that include property valuation to take place, tailored interest rates, and favorable repayment terms.

Can I add the IMT tax due to the total mortgage sum?

In Portugal, the IMT, or property purchase tax, should be paid separately from the mortgage payments.

Can a foreigner get a mortgage in Portugal?

Since 2017, it has been possible to take out up to around 70 percent of the sale price as a loan as a foreigner. Portugal mortgages are usually given to people aged 65 and under, although certain banks extend this to 70 or 80 years old. The mortgage process is simple and even encouraged by Portuguese institutions.

Are there any restrictions for foreigners obtaining a mortgage in Portugal?

Foreigners can get a mortgage in Portugal without restrictions. A mortgage lender will only deem your application unsuccessful if the applicant does not meet the eligibility criteria.

Is it better to get a Portuguese mortgage?

Getting a Portuguese mortgage is very common, and you will be able to secure a mortgage regardless of whether you are a resident or are looking for mortgages in Portugal for non-residents. There are many banks offering mortgage loans in Portugal.

What documents are needed to apply for a mortgage in Portugal?

To apply for a mortgage in Portugal, you will need to have the following documents to hand:

- Copy of passport

- Portuguese tax resident number (NIF number)

- Proof of income

- Bank statements

- Recent utility bills

- Recent mortgage statements

- Proof of any savings or investment accounts

- Bank account reference letters

- Property details – buying commitment or sales contract

You will also be required to show additional documents, which will depend on your employment status. If you are a retiree, you must be able to prove a regular pension income. Please note that the bank may request more documents in addition to proof of your pension income.

What are the interest rates for mortgages in Portugal?

Portugal mortgage rates for foreigners depend on many different factors. These include the size of the down payment or loan-to-value ratio (LTV), the location of the property, whether you are in full-time employment or are self-employed, and the bank’s assessment of your risk as a borrower.

A variable-rate mortgage depends on the Euribor rate, and the spread offered by the bank, which usually ranges between 1 percent and 2 percent in most institutions. The monthly payment will fluctuate over time.

For a Portugal fixed-rate mortgage, borrowers can pay a fixed rate for a certain period and will usually be guarded against fluctuations in the Euribor. Banks in Portugal will offer fixed rates from anywhere between three to 30 years and will charge a significant premium for this. To provide you with an example, there are fixed-rate mortgage options that are available at 4.3 percent (TAEG) for up to two years based on a loan-to-value ratio (LTV) of up to 70 percent.

What is the debt-to-income ratio assessment?

At the beginning of the lending process, Portuguese mortgage lenders will conduct a debt-to-income ratio assessment. This assessment entails taking your monthly debt payments, such as loans and other mortgages, and dividing this by your gross monthly income. A debt-to-income ratio between 35 and 40 percent is usually most acceptable. If your application is approved, the lenders can then assist with the necessary legal checks for the property and arrange a valuation.

How much deposit do you need for a mortgage in Portugal?

In Portugal, the minimum deposit required for a mortgage depends on your residency status. Non-residents typically face a higher hurdle, needing to put down at least around 20-40 percent of the property’s purchase price. This is because mortgage lenders in Portugal usually only provide between 60 and 80 percent of the valuation price for non-residents.

Can I get a 100 percent mortgage in Portugal?

Depending on the mortgage lenders you work with, a Portugal mortgage for expats will only cover between 60 and 70 percent of the property’s purchase price for non-residents.

What are the typical fees associated with obtaining a mortgage in Portugal?

You’ll incur a stamp duty tax of 0.8 percent of the property price. Factor in notary and tax office fees, which total around €500- €1,000 and Land Registry fees of €250 for the mortgage deeds. Finally, there’s the property tax/purchase tax (IMT), ranging from 0 to 10 percent of the property price, depending on the specific property and location.

How does the bank assess property value for mortgage purposes in Portugal?

In Portugal, the bank evaluates property value for mortgages by scrutinizing various factors. They analyze credit scores to gauge creditworthiness, calculate debt-to-income ratios, and assess loan-to-value ratios. Additionally, they consider amortization schedules, insurance requirements, and potential early repayment charges.

Can I repay my mortgage early in Portugal, and are there any penalties?

Yes, in Portugal, you can repay your mortgage early, but it incurs penalties. If you choose early repayment, a small fee of around 0.5 percent of the property value, accounting for taxes, applies. Additionally, upon property sale, you’re taxed on the repaid capital. These penalties are considerations for borrowers planning early mortgage settlements.

What insurance is required when taking out a mortgage in Portugal?

When securing a mortgage in Portugal, certain insurance is mandatory. This includes property insurance and mortgage life insurance. Some banks impose an obligatory requirement for life insurance to ensure repayment in the event of unexpected circumstances. These insurance policies are essential components of the mortgage application process in Portugal.

Are there any government schemes available to help with buying a home in Portugal?

There are no government incentives or programs to help non-residents purchase property in Portugal. However, the Portuguese government does offer subsidized housing loans and tax benefits for first-time home buyers who are Portuguese residents, such as the IMT exemption for first-time buyers.

What are the Portuguese long term interest rates?

As of November 2024, Portugal’s long-term interest rate is 2.79 percent. This rate is still below the long-term average of 4.87 percent. Meanwhile, mortgage rates in Portugal can range from 1 to 8 percent, depending on the value of the property, type of mortgage, etc. For the best rates, make sure to check individual bank websites or contact a mortgage broker.

What is the maximum loan-to-value for Portuguese mortgages?

Most banks in Portugal offer a maximum loan-to-value (LTV) of 60 to 70 percent for non-residents, although this could vary.

How much can I borrow for a mortgage in Portugal?

The amount you can borrow typically depends on your income, but the minimum deposit you will require is usually at least 30 percent of the purchase price of the property.

What are the lending criteria for a mortgage in Portugal?

Mortgage lenders typically look at income, employment status, credit history, and existing debts to determine eligibility against the value of the property.

Should I buy property in Portugal?

Portugal offers affordable property prices, attractive residency programs, and beneficial mortgage rates, making it a smart choice for property investment.

What is the age limit to take out a mortgage?

Most banks have an age limit between 60 and 70 years old, but the mortgage may carry on into retirement provided you have sufficient pension income.

Can retirees take out a mortgage in Portugal?

Yes, retirees can get a mortgage in Portugal as long as they can demonstrate a stable income or pension. However, it gets more difficult to find a bank to offer a mortgage after 70 years old.

How long does it take to buy a house in Portugal?

The process usually takes three to six months, depending on factors like property searches, financing, and legal checks.

Is it difficult to get a mortgage in Portugal?

While the process involves certain requirements, paperwork, and checks, it’s generally a straightforward process, especially with professional guidance from a mortgage broker.

What are the mortgages available in Portugal for non-residents?

Non-residents have access to fixed-rate and variable-rate mortgages in Portugal, with terms between 25 to 30 years and based on up to 70 percent loan-to-value mortgages.

What are the mortgages available in Portugal for residents?

Residents have more flexible mortgage options, including higher loan-to-value ratios of between 80 to 90 percent.

Can I get a mortgage in Portugal as a UK resident?

Yes, both Portuguese residents and non-residents can apply for mortgages in Portugal.

What do you need to get a mortgage in Portugal?

To get a mortgage in Portugal, some of the documents you’ll need are proof of income, bank statements for the past three months, proof of identity, proof of address, and a Portuguese tax number (NIF). There are also additional documents you may need, depending on if you are employed, self-employed, or if you have other income sources.

What are the mortgage conditions in Portugal?

Conditions vary but often include a loan-to-value of up to 70 percent, with a 30 percent down payment typically required for non-residents. The mortgage term is usually between 25 to 30 years.