Updated: December 12, 2025

Buying property in Lisbon, Portugal, is becoming increasingly attractive to both local and international buyers. The capital city offers a high quality of life, strong rental yields, booming tourism, and a stable economy.

Foreigners can freely buy any type of property, like a house, apartment, luxury villa, commercial property, or land, with the same rights as Portuguese citizens. However, since the property market is fragmented, many foreign buyers struggle to find a property that fits their budget. That’s where we can help.

In this article, we compiled a step-by-step guide to the legal requirements for buying property, average asking prices, and necessary documents. We will also compare the best neighborhoods in Lisbon for rental yields.

Stick around to read about:

Key Takeaways about Buying property in Lisbon

- US citizens can freely buy property in Lisbon without restrictions, as long as they have a NIF number and a proper visa if they plan to stay long-term.

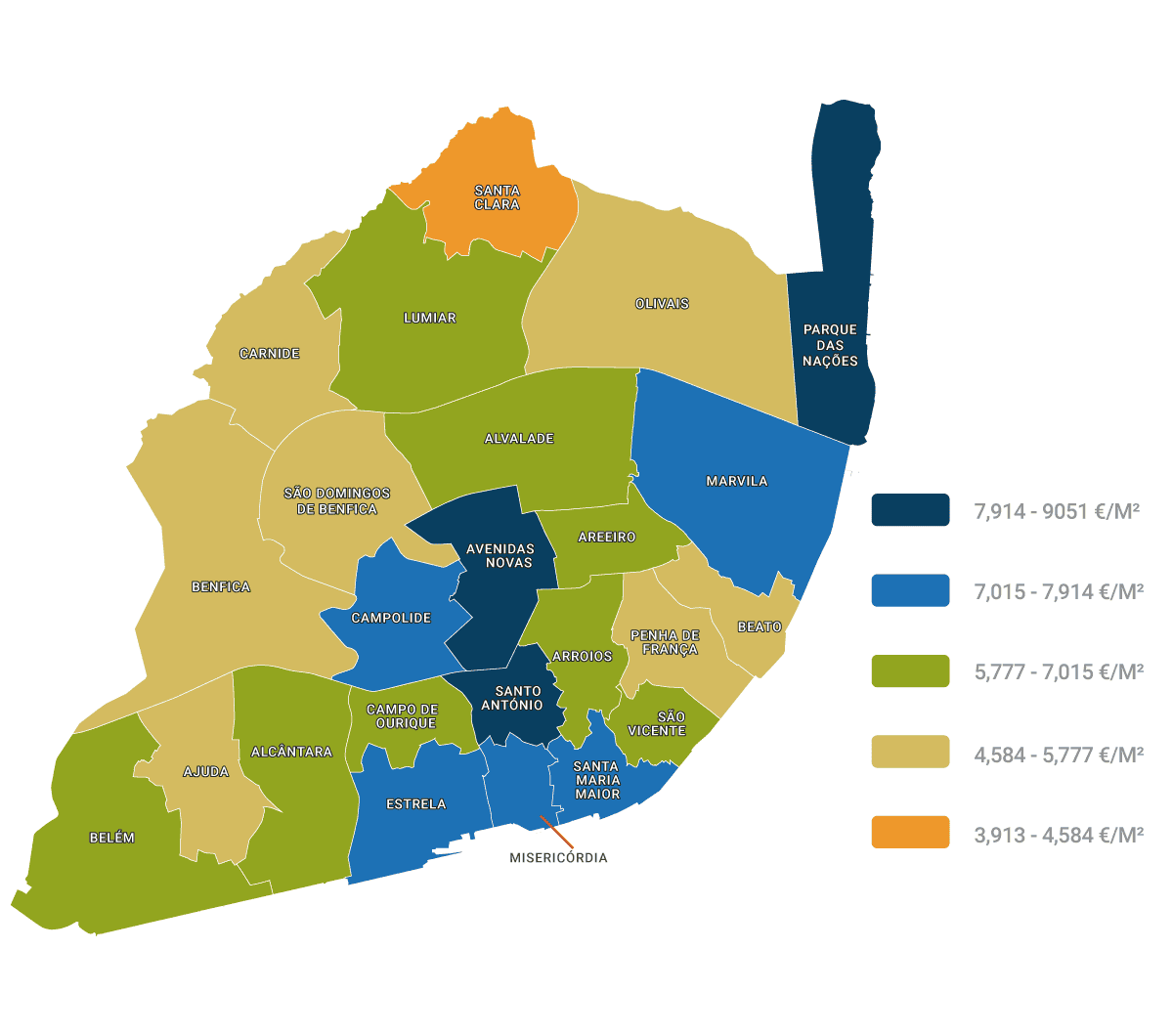

- The average asking price in Lisbon varies from €4,935 to €6,934 per square meter, depending on the neighborhood and type of property.

- The typical rental market in the Greater Lisbon Area can offer solid returns of 6.8 percent.

- You can buy property for a decent price in an up-and-coming neighborhood like Marvila, Beato, Alcântara, and Benfica. They have a high potential for capital appreciation.

- When you buy a house, the price you agree to pay the seller is not the final cost. You should budget an additional 7 to 10 percent for extra taxes and fees, which include the Municipal Property Transfer Tax (IMT), Stamp Duty, notary, and legal fees.

Why buy property in Lisbon?

Lisbon is a hotspot for expats, tourists, digital nomads, and retirees, and for many reasons. Here is a list of the advantages of buying property in Lisbon.

Lisbon is a hotspot for expats, tourists, digital nomads, and retirees, and for many reasons. Here is a list of the advantages of buying property in Lisbon.

- Choose from a wide range of properties, including modern apartments, historic properties, coastal luxury villas, and spacious houses with views of the Tagus River.

- Enjoy a high quality of life with a warm climate, beautiful beaches, rich history, excellent infrastructure, and transport links.

- Since the Web Summit relocated in 2016, the Portuguese capital has become a booming tech hub, attracting international companies and startups.

- While property prices are increasing, the Lisbon housing market offers better property value with lower prices compared to other European cities, like Paris and London.

- With average rental yields of 6.8 in the Greater Lisbon area, the capital is a profitable area for rental income, according to the property databank Confidencial Imobiliário.

- Lisbon is a safe place to live with good political stability. Based on reports from the 2025 Global Peace Index (GPI), Portugal is the 7th safest country in the world, which is why many property buyers choose to purchase residential and commercial properties here.

Can foreigners buy property in Lisbon?

Yes, foreigners buying property in Lisbon will face no restrictions. The buying process is accessible and requires a Portuguese NIF number and funding.

A NIF in Portugal is a nine-digit tax number that is mandatory for both residents and non-residents who wish to purchase property, open a bank account, or engage in any other financial activity. You can obtain your NIF immediately by visiting a tax office or applying remotely through a legal representative, which typically takes 5 to 10 business days.

Where to buy property in Lisbon?

With a wide variety of Portugal homes on the market, your choice of neighborhood should fit your goals, budget, and type of lifestyle you are after.

Here are some of the best areas for buying property in Lisbon as a foreigner.

Best for lifestyle and luxury properties

Best for lifestyle and luxury properties

The top Lisbon neighborhoods for lifestyle buyers are often Chiado, Príncipe Real, and Avenida da Liberdade. They offer prestige, architectural charm, and a high quality of life, though rental yields are typically lower than in emerging areas.

The top Lisbon neighborhoods for lifestyle buyers are often Chiado, Príncipe Real, and Avenida da Liberdade. They offer prestige, architectural charm, and a high quality of life, though rental yields are typically lower than in emerging areas.

Their main advantage is the long-term price growth that often outperforms prime districts in other Western European countries. You get access to historic neighborhoods and the prestigious riverfront areas of the Lisbon coast. These areas are prime locations for a holiday home and dominate the high-end short-term rental market.

Real estate investment in Cascais is also desirable and is just a 30-minute drive from Lisbon city center. This coastal town combines beaches, high-end living, and a strong appeal for those seeking to get a strong return on their property purchase.

Best for families and long-term rentals

Best for families and long-term rentals

For families and long-term rental strategies, Estrela, Lapa, and Avenidas Novas offer the ideal balance of comfort, stability, and steady returns.

For families and long-term rental strategies, Estrela, Lapa, and Avenidas Novas offer the ideal balance of comfort, stability, and steady returns.

There are many schools in the area, as well as large green spaces, making it perfect for raising a family. Yields here tend to be moderate but consistent. They have low vacancy rates and strong tenant profiles. The main advantages in these neighborhoods are the dependable property value growth and family-friendly living.

You may also want to consider a more affordable area in Lisbon, such as Lisbon South Bay, where there is strong potential to unlock lucrative returns on rental income in the coming years if you enter the rental market.

Best for property value and growth

Best for property value and growth

Up-and-coming areas like Marvila, Beato, Benfica, Lumiar, and Ajuda have high property values. Due to significant regeneration, the areas draw new businesses and modern residential projects. Properties here are more affordable compared to those in the central core. They are ideal for pure rental investment due to regeneration and faster appreciation.

Up-and-coming areas like Marvila, Beato, Benfica, Lumiar, and Ajuda have high property values. Due to significant regeneration, the areas draw new businesses and modern residential projects. Properties here are more affordable compared to those in the central core. They are ideal for pure rental investment due to regeneration and faster appreciation.

A Marvila real estate investment could be an excellent financial and strategic move. The one disadvantage is the lack of transport infrastructure, a problem which is now being addressed by major public investment, most notably the new 16E tram line. Plus, you’ll find a quieter lifestyle, filled with local restaurants and cafés where you can get to know the owners and build closer relationships.

Wondering what the average property prices are in different Lisbon neighborhoods? The table below provides a general estimate.

Neighborhood | Average price per square meter | Average rental yield (in percentage) |

Avenidas Novas | €8,377 | 3.0 – 4.0 |

Estrela | €7,694 | 3.8 – 5.0 |

Parque das Nações | €8,517 | 3.0 – 4.0 |

Lumiar | €5,785 | 5.0 – 5.4 |

Benfica | €5,123 | 5.5 – 5.9 |

Ajuda | €5,366 | 4.5 – 5.4 |

Marvila | €7,098 | 4.0 – 4.5 |

Beato | €4,896 | 4.0 – 4.5 |

Source: Confidencial Imobiliário

How much does it cost to buy property in Lisbon?

The total asking price of a property for sale in Lisbon varies from €4,935 to €6,934. In 2024, the average rental yield in the Greater Lisbon Area was 6.8 percent, creating valuable opportunities to earn a rental income.

However, the purchase price is not the only expense when it comes to buying property in Portugal. Instead, buyers should set aside 7 to 10 percent for additional costs, including taxes and professional fees.

Average prices

Average prices

The average property prices are different based on the location and the type of property. For example, with a budget of over €150,000, buyers can find small studio apartments or renovation projects in outer districts. These are usually very small 20 to 35 square meter studios close to the suburbs.

You can expect to spend €300,000, on a one-bedroom apartments or small two-bedroom units in need of renovation in areas like Penha de França, Benfica, and Lumiar. With €500,000, buyers typically access two-bedroom apartments or small, centrally located flats in neighborhoods such as Campo de Ourique, Arroios, and Alvalade.

A budget of €1,000,000 can secure spacious apartments or small houses in premium areas like Estrela, Lapa, Chiado, or Avenida da Liberdade.

Taxes & fees

Taxes & fees

Both expats and locals pay taxes and additional fees when purchasing property in Portugal. They fall into two main categories: one-time taxes (paid at the time of the purchase) and annual taxes (paid every year of ownership).

Both expats and locals pay taxes and additional fees when purchasing property in Portugal. They fall into two main categories: one-time taxes (paid at the time of the purchase) and annual taxes (paid every year of ownership).

Our comprehensive guide to property taxes in Portugal provides a detailed overview of the expenses. But here is a quick overview to get you started.

The one-time costs are:

- IMT (Property Transfer Tax): Also known as Imposto Municipal sobre a Transmissão, it is based on the purchase price or the property’s tax value (VPT). The rates usually vary from 1 to 8 percent and depend on location, intended use, property value, and property type.

- Stamp Duty (Imposto de Selo): There is a fixed rate of 0.8 percent of the property’s purchase price.

- Notary fees: €500 to €1,000

- Legal fees: €2,000 to €5,000

- Land use registration: €200 to €250

The annual taxes are:

- IMI (Annual Municipal Property Tax): Also known as Imposto Municipal Sobre Imóveis, this ongoing tax is set by the Tax Authority (Finanças) and is based on the taxable property value (VPT). Rates often vary; urban properties can reach as high as 0.5 percent in certain circumstances, while rural properties typically have a rate of 0.8 percent.

- AIMI (Additional Municipal Tax): This is an extra tax only applied to owners whose total share of Portuguese property (VPT) exceeds €600,000. In Portuguese, it is called Adicional ao Imposto Municipal Sobre Imóveis.

Note: If you earn a rental income from Lisbon apartments, then you are subject to rental income tax. But if you decide to sell the property, then you must pay capital gains tax in Portugal on the profit you earn.

Types of Properties for Sale in Lisbon

The property market in Lisbon is dynamic and varied. You’ll find an array of spectacular property types in Lisbon, leading up the Portuguese Riviera towards Cascais. From modern apartments with stunning views of the Tagus River to spacious villas and mansions, you’ll find the depth of the Lisbon real estate investment market to be extraordinary.

The property market in Lisbon is dynamic and varied. You’ll find an array of spectacular property types in Lisbon, leading up the Portuguese Riviera towards Cascais. From modern apartments with stunning views of the Tagus River to spacious villas and mansions, you’ll find the depth of the Lisbon real estate investment market to be extraordinary.

If you are considering buying an apartment in Lisbon, think about how many bedrooms you’d like your dream property to have, as this will help you refine your search.

Whether you are looking to be close to the picturesque city center or prefer a country house a short drive from the city, there are plenty of options on the table. You will want to visit Lisbon and explore the different neighborhoods to ensure you choose the perfect property and the ideal part of the city for you.

How to find property in Lisbon, Portugal?

Searching for your dream home is much easier when you know where to look. Start by browsing property listing platforms focused on Lisbon. A property finder in Portugal can help you find luxury apartments for sale in Lisbon online. You can use them to compare prices across neighborhoods.

You can also work with top real estate agencies specializing in Lisbon properties. A real estate agency specializes in market valuation, targeted marketing, and administrative support. They tailor their services to the seller, locating properties nationwide.

But many buyers choose to work with a buyer’s agent because they act solely in the buyer’s interest. They help negotiate the best price and can pinpoint off-market properties. A buyer’s agent, such as Goldcrest, can help you find properties for sale in Lisbon that match your budget and preferences. They also offer expert guidance on market trends and the purchasing process, so you can decide which area suits you.

Required Documents to Buy Property in Lisbon

Before you can purchase property in the capital city of Portugal, you must obtain a Portuguese tax identification number (NIF). The tax ID is mandatory for all financial transactions, such as buying property, opening a Portuguese bank account, signing contracts, or paying taxes.

Before you can purchase property in the capital city of Portugal, you must obtain a Portuguese tax identification number (NIF). The tax ID is mandatory for all financial transactions, such as buying property, opening a Portuguese bank account, signing contracts, or paying taxes.

Non-residents are required to have a fiscal representative to obtain a NIF. Here is a list of the documents foreigners need:

- Personal identification: Such as a valid passport or national ID card.

- Proof of address: You can use recent bank statements, salary slips, tax returns, and credit liabilities from your country of residence.

- Land Registry certificate (Certidão do Registo Predial): The seller provides this document to confirm ownership, mortgages, or other legal factors.

- Tax registration certificate (Caderneta Predial): This is a tax registry document from the tax office that the seller can use to show fiscal registration, taxable value, and property description.

- Energy Performance certificate (Certificado Energético): It shows how energy-efficient the property is based on specific ratings.

- Usage or habitation license (Licença de Utilização): This is a property-related document from the seller that proves the property can be legally used.

- The Promissory Contract or CPCV (Contrato Promessa de Compra e Venda): This is a preliminary contract that outlines the terms of sale.

- Final deed (Escritura): This is a formal deed for officially transferring property ownership.

- Receipt of payment for IMT (Municipal Property Transfer Tax): This is a one-time tax paid at varying rates.

- Receipt of payment of Stamp Duty: This is a one-time tax paid usually at a fixed 0.8 percent rate.

If you’re buying property from abroad, it’s important to understand how to hire a real estate lawyer for purchasing property in Lisbon remotely. They can assist you in collecting all the necessary documents and completing due diligence checks to ensure the property is free from hidden debts and that the seller can legally transfer ownership.

A Step-by-Step Guide to Buying Property in Lisbon, Portugal

So, what are the legal steps to buy a property in Lisbon as a foreigner? You can expect a straightforward and accessible purchasing process. Here is how it works:

- Step 1: Apply for a Portuguese Tax Identification Number (NIF). You can go to a tax office or appoint a lawyer or representative to do it for you.

- Step 2: Open a Portuguese bank account and figure out which financing option you would choose.

- Step 3: Work with a buyer’s agent or a real estate agent in Lisbon to search for homes in the neighborhood you prefer. A buyer’s agent can negotiate prices and make an offer on your behalf.

- Step 4: Sign the CPCV (Promissory Contract). This binds both sides to the sale price, terms, and deadline. At this stage, you pay a deposit of about 10 percent of the purchase price.

- Step 5: Sign the Escritura (deed). Both parties meet at a notary’s office (Escritura Pública de Compra e Venda), where the buyer pays the remaining balance, and the seller transfers full ownership.

- Step 6: Register your property with the Land Registry. At this stage, you should also notify the Tax Authority so they can officially establish your legal title in Portugal.

How to finance a Lisbon property purchase?

If you have the funds, you can buy the property outright with a single payment. But, for those who can’t afford it, Portuguese banks can provide a mortgage. The maximum amount a buyer can borrow depends on the loan-to-value ratio.

If you have the funds, you can buy the property outright with a single payment. But, for those who can’t afford it, Portuguese banks can provide a mortgage. The maximum amount a buyer can borrow depends on the loan-to-value ratio.

There are three primary types of mortgages: fixed-rate, variable-rate, and mixed-rate. Residents with a fiscal number can borrow up to 80 to 90 percent of the property cost. For non-residents, the maximum loan-to-value ratio for mortgages is typically 60 to 80 percent.

So, which banks offer mortgage services for buying property in Lisbon? There is a great selection of mortgage options from providers, including BBVA, Santander, Banco Best, Bankinter, and Banco CTT.

Wondering how to get a mortgage for buying property in Lisbon from the US? American buyers need a Tax Identification Number (NIF), proof of income, credit history, and property valuation. To learn more, explore our comprehensive guide to mortgages in Portugal for foreigners.

Visa and Residency Options

Owning property in Portugal does not automatically grant you residency. If you are purchasing a property for long vacations or to live in permanently, you will need to secure one of the valid visa options Portugal offers.

Owning property in Portugal does not automatically grant you residency. If you are purchasing a property for long vacations or to live in permanently, you will need to secure one of the valid visa options Portugal offers.

The visa options for non-EU citizens looking to become property owners include the Portugal D7 Visa (Retirement or Passive Income Visa), the Digital Nomad Visa (for remote workers), and the Portugal Golden Visa program (for investors).

There is a wide range of residency options available for those buying property in Lisbon. If you want to discuss your options, feel free to get in touch with our citizenship and residency division, Global Citizen Solutions, who will be more than happy to help you with relocating to Portugal.

Goldcrest: How We Can Help You

Goldcrest is a buyer’s agent that is based in Lisbon. We provide expert, impartial advice on real estate investments and how to buy property in Portugal. From scouting out the perfect property through to property acquisition, we have you covered throughout the process.

If you are looking to purchase property in Portugal, don’t hesitate to get in touch. Our team of skilled experts is available to solve all your real estate doubts, helping you with the property search and offering insightful expertise and strategic advice.

Why choose Goldcrest?

- Local knowledge: With offices located across Portugal, our presence nationwide allows us to assist you personally across the country.

- Independent service: As an independent buying agent, we do not represent any development or project. Our service is entirely tailored toward each individual client, providing you with everything you need to secure the perfect property at the best possible price. As an impartial advisor on the market, we work solely on behalf of our client and provide a service tailored to your needs and requirements.

- Streamlined process: Our real estate agents speak English and Portuguese, and our service is completely focused on providing you with a hassle-free buying experience, saving you time.

- Experienced team: Our expert real estate team has a vast local knowledge of the Portuguese property market. We have cutting-edge technology and metasearch tools at your disposal to provide full market coverage, ensuring the best investment choices and negotiated prices.

- Network of partners: We have a close network of partners, including lawyers, property management services, builders, architects, designers, and landscape gardeners, again saving you time and hassle by providing you with trusted experts in their field of work.

Frequently Asked Questions About Buying Property in Lisbon

Are there any restrictions to buying a house in Lisbon as a foreigner?

There are no restrictions on buying a house in Portugal as a foreigner or on foreign property ownership. The country has an open property market that doesn’t discriminate against nationality.

Where are the best neighborhoods to buy a house in Lisbon, Portugal?

The best neighborhoods in Lisbon to buy a residence include Alcântara and Anjos, which are modern areas that attract digital nomads and young professionals. Areas like Alfama and Graça offer authentic Portuguese charm and a unique living experience, while areas such as Estrela and Lapa are popular choices for families.

What's the cheapest place to buy property in Lisbon?

You can find small studious and renovation projects at affordable prices of €150,000 in outer districts and suburbs. Neighborhoods like Lumiar, Benfica, and Penha de França can offer one-bedroom apartments for €300,000.

Do I need a lawyer when buying a house in Lisbon?

Working with a real estate lawyer in Lisbon to purchase property is not mandatory, but it is highly recommended. You can get technical and legal support on the specific requirements of the city’s property market.

What is the average price of a property in Lisbon?

In Lisbon, the average asking price for property was €6,934 per square meter in 2024, while in the Greater Lisbon Area, the average asking price was €4,935. Average property prices in Portugal vary depending on the neighborhood and whether you are looking for residential or commercial property.

Can I buy a house in Lisbon without being a resident?

Yes, you can purchase a house or any type of property without being a resident of Portugal or an EU citizen. Portugal has an open property market that places no restrictions on foreign property ownership.

Is it worth buying property in Lisbon?

Buying property in Lisbon is worth it for buyers seeking strong rental yields, steady capital growth, and lifestyle benefits. The city offers convenient property taxes and a stable economy. However, you must also consider the rising prices and intense competition, especially in top tourist destinations such as Baixa, Chiado, Alfama, and Bairro Alto.

How much tax do I pay when buying a property in Lisbon?

When you are buying property in Lisbon, you often pay three main taxes: IMT (Property Transfer Tax), Stamp Duty, and Annual Municipal Tax (IMI). To cover the buying costs, you should set aside at least 7 to 10 percent of the property price.

What is the process for buying a house in Lisbon for non-EU citizens?

Non-EU citizens are required to obtain a Portuguese tax number (NIF) and appoint a tax representative. It is also recommended to open a Portuguese bank account to avoid transaction fees. The process to buy property in Lisbon involves the property search, securing financing, making an offer, signing a promissory contract, and finalizing the sale.

Can Americans buy property in Lisbon?

Yes, Americans can buy property in Lisbon without restrictions. You will need to have a Portuguese tax number (NIF) and appoint a tax representative. It is also advisable to open a Portuguese bank account to minimize transaction fees.

Can I buy a house in Lisbon and live there permanently?

Buying a house in the Portuguese capital doesn’t grant residency. If you wish to live in your home permanently, you must apply for a long-term residency visa before moving. The most popular options are the D7 Passive Income Visa (Retirement Visa), D8 (Digital Nomad Visa), or the Portugal Golden Visa (residency by investment program).

How long can you stay in Portugal if you own a property?

It depends on your country of origin. As a non-resident property owner, you must follow the standard travel rules for the Schengen Area. You can remain in the country for 90 days within any 180-day period. To stay longer, you will need a legal residency status.

Is Airbnb profitable in Lisbon?

Yes, Airbnb can be profitable due to Lisbon being a major tourist destination and high occupancy rates, especially in central areas. Profitability depends on location, property quality, and seasonality. When buying property to rent short-term on Airbnb, it’s important to be cautious of the local restrictions, which you can learn more about with our Alojamento Local (AL) guide.

What are the pitfalls of buying property in Lisbon, Portugal?

The downsides of buying property in Lisbon include inflated asking prices in tourist areas and hidden costs for renovations. There is a chance you may encounter unclear property titles, zoning restrictions, and fluctuating rental regulations. A buyer’s agent like Goldcrest can do a thorough due diligence and property management, so you can get the most out of your property purchase.