Updated: December 23, 2025

Property investors looking for their next lucrative deal and expats moving to Portugal, deciding whether to purchase or rent a home, have one common question in mind: Is now the prime opportunity for buying property in Portugal in 2025?

The short answer is: Yes, 2025 is an excellent time to buy property in Portugal. The country is a top destination for international buyers in 2025, especially for those looking for a good investment property. However, whether buying property is the right move for you is more nuanced. Since we have passed the midpoint of 2025, we have all the information you need to make an informed decision.

In this article, we dive into 2025 insights for buying property in Portugal through a comprehensive real estate market analysis. We will explore pricing trends, mortgage rates, supply and demand dynamics, government policies, and economic growth to give you a clear outlook on what’s shaping Portugal’s property market for the rest of this year and beyond.

In this article, you’ll learn more about:

Portugal's Property Market in Mid-2025: A Snapshot

The Portuguese property market looks promising in 2025, making it a great time to buy property. Factors like strong economic growth, favorable financing terms, and declining interest rates contribute to this positive outlook. The Portuguese real estate market is also expected to continue its growth trajectory, with increasing transaction volumes and investment.

Here is a snapshot of important key indicators and trends of the market, and what it means for buyers:

Indicator | Mid-2025 figures | Good or bad for buyers? |

Average property price | €2,701 Per square meter nationally. | Neutral: Rising prices mean some might struggle to afford to buy. However, property is still more affordable compared to other Western European countries |

Property value growth rate | 15.8 Percent annual increase in house prices | Good: Indicates a healthy and in-demand market with strong potential for capital gains |

Mortgage rates | Fixed rate: 2.5 - 3.8 Percent Variable rate: 2.3 - 3.2 Percent Mixed rate: 2.70 - 3.5 Percent | Good: Makes financing your purchase more affordable, increasing purchasing power |

Rental yields | Lisbon: 5.2 - 7.8 Percent Porto: 5.7 - 6.6 Percent Algarve: 5 - 6 Percent | Good: High demand for rentals means potential for good passive income if you're looking to rent out your property. |

Market supply vs demand | Supply is limited, overall demand outweighs supply, but this will vary per region | Good: Points to strong buyer activity and continued confidence in the property market |

Sources: Statistics Portugal, Eurostat, Global Property Guide, Confidencial Imobiliário, and Santander

Based on the indicators above, we can see that Portugal’s property market is stable and showing signs of sustainable growth. Plus, if you are asking yourself, can foreigners buy property in Portugal? You’ll be pleased to know that you’ll face no restrictions. Below, we unpack some of these factors in more detail.

Current price dynamics and growth rates

Current price dynamics and growth rates

A 15.8 percent growth in the Portuguese property market as of March 2025 shows impressive momentum, outpacing the broader EU market and pre-pandemic levels.

A 15.8 percent growth in the Portuguese property market as of March 2025 shows impressive momentum, outpacing the broader EU market and pre-pandemic levels.

The property market in Portugal continues to strengthen through increased foreign investment and a high demand for Portuguese property. It is predicted to grow at over twice the rate of the EU, the UK, and North America by 2027.

Despite the strong growth rates, a big draw for the property market is that it is still more affordable compared to other Western European countries. The enhanced lifestyle of Portugal and strong potential for appreciation make the property prices well worth it.

Property prices per region also vary significantly, offering opportunities for all budget levels, including really affordable options compared to Western Europe. On the other side of the spectrum, Portugal’s luxury real estate is one of the leading property management markets in the world.

You can expect the following average home prices in Portugal per region:

- Lisbon Metropolitan Area: €4,935 per square meter

- Porto Metropolitan Area: €3,937 per square meter

- Northern Portugal: €1,903 per square meter

- Central Portugal: €2,098 per square meter

- Alentejo: €3,181 per square meter

- Algarve: €4,385 per square meter

Transaction volumes and market activity

Transaction volumes and market activity

From January to March 2025, 41,358 homes were sold in Portugal, a 25 percent increase compared to the same period last year. This shows increasing buyer confidence and healthy liquidity in the market.

Because of the high demand for property in Portugal, especially in the most sought-after markets like Lisbon and the Algarve, property listings don’t stay on the market very long. This means that buyers will need to act fast when searching for property in these areas – especially when looking for a studio apartment.

A property professional, like a buyer’s agent, will be able to help in this case, as they have a database of off-market listings that buyers can access first-hand.

Mortgage landscape and interest rates

Mortgage landscape and interest rates

The Euribor rate, which is the main influencer behind variable mortgage rates in Portugal, has shown a consistent downward trend in 2025, reaching lows not seen since late 2022. This directly translates to more affordable variable-rate mortgages and has also put downward pressure on fixed rates.

The European Central Bank’s recent interest rate cut in June 2025 (to two percent) follows this trend, easing mortgage repayments and increasing purchasing power. Looking ahead, mortgage rates in Portugal are expected to keep falling until 2026, but more slowly.

For foreign buyers, Portuguese banks offer mortgages that are highly accessible, generally offering loan-to-value (LTV) ratios of 60 to 80 percent for non-residents, and even higher (up to 90 percent) for residents. These favorable terms are another advantage of buying property in Portugal in 2025.

Key Influencers Shaping the Portuguese Property Market in 2025

Looking at Portugal house prices, interest rates, and sales trends in the real estate market above, it’s easy to get caught up in the numbers without focusing on the broader picture.

However, understanding the forces at play behind Portugal’s thriving property market is crucial for any potential buyer.

Several factors are currently shaping its dynamics, from shifting demand patterns to government policies and economic influences. In this section, we explore these factors in more detail.

Foreign demand and shifting motivations

Foreign demand and shifting motivations

The end of the real estate investment option to qualify for Portugal’s Golden Visa undoubtedly caused a shift in foreign demand trends for property in the country.

The end of the real estate investment option to qualify for Portugal’s Golden Visa undoubtedly caused a shift in foreign demand trends for property in the country.

While there was a brief slowdown, the market remained resilient thanks to other visa options. The Portugal D7 Visa (for passive income earners) and the newer Portugal Digital Nomad Visa (D8 Visa) are attracting a steady stream of long-term residents and remote workers.

These individuals often seek rental properties initially, but frequently decide to buy property to settle for good, driving up demand. Currently, over 70 percent of people living in Portugal own a home.

Beyond visas, Portugal’s lifestyle and high quality of life sell themselves. Its mild climate, safety, welcoming locals, rich culture, excellent healthcare, international schools, and relatively lower cost of living compared to other Western European countries are the key reasons foreigners are snapping up property to relocate to Portugal.

Real estate market Portugal: The supply-demand imbalance

Real estate market Portugal: The supply-demand imbalance

Despite strong demand for properties, the market faces a limited supply of new housing. Delays in building permits, rising construction costs, and labor shortages have slowed new developments.

While there’s a push for rehabilitating older properties, the pace hasn’t been enough to fully meet demand, keeping pressure on prices in many areas. A property finder in Portugal can keep you in the loop on the latest market trends and offer valuable insight.

Government policies and the housing shortage

Government policies and the housing shortage

The Portuguese government has implemented various initiatives to address housing affordability and availability, which are having diverse impacts on the market.

- Mais Habitação (More Housing) measures: Key elements include restrictions on issuing new Alojamento Local licenses for short-term rentals in certain high-density urban areas, like Lisbon. There are also financial incentives that have encouraged a shift towards favoring long-term rentals over short-term rentals, such as tax deductions for maintenance and management costs, property purchase costs, IMI annual municipal property tax, and other property-related expenses.

- Tax incentives: The popular Non-Habitual Resident (NHR) tax regime, offering significant tax benefits, is no longer available. However, a new tax incentive program for Scientific Research and Innovation (IFICI), nicknamed NHR 2.0, has been introduced, aimed at highly qualified professionals. While more targeted, this new regime still provides tax advantages that may attract foreign residents.

Macroeconomic factors

Macroeconomic factors

Portugal’s economy remains on a solid footing, with steady GDP growth supporting employment and real estate investment opportunities.

While inflation has been a challenge across Europe, forecasts suggest it is gradually easing, which helps stabilize property prices and maintain buyers’ purchasing power, making the market more predictable and attractive.

2025 Outlook: Investment Opportunities by Region

Let’s say that after considering 2025 insights for buying property in Portugal, you decide that it is time to purchase your own slice of Portugal – which region would suit your goals best?

Below, we share a brief overview of each region of Portugal and the foreign property ownership opportunities they offer.

Lisbon Metropolitan Area: Resilience and luxury

Lisbon Metropolitan Area: Resilience and luxury

Lisbon remains Portugal’s most sought-after urban property market, especially for luxury buyers, entrepreneurs, and investors after long-term rentals.

While property prices are the highest in the country, demand stays strong, particularly in prime neighborhoods in Lisbon like Príncipe Real, Estrela, and Parque das Nações.

Lisbon is one of the prime areas affected by Alojamento Local license restrictions in certain areas. Because of this, the city has seen investors shift their focus toward long-term leases instead. Regardless, rental yields reach as high as 7.8 percent in some municipalities in Lisbon.

Porto Metropolitan Area: Growth and innovation hub

Porto Metropolitan Area: Growth and innovation hub

Porto has built an identity as a vibrant, growing tech and cultural hub. Urban renewal projects and public infrastructure improvements have boosted the city’s appeal, both for residents and foreign investors.

Porto has built an identity as a vibrant, growing tech and cultural hub. Urban renewal projects and public infrastructure improvements have boosted the city’s appeal, both for residents and foreign investors.

Offering more of a traditional Portuguese experience compared to Lisbon, many expats choose to settle here to enjoy the authentic Portuguese cultural experience while still having access to strong expat communities. Porto also offers a thriving luxury property market for lifestyle buyers.

Some of the best neighborhoods in Porto for expats like Bonfim, Campanhã, and Matosinhos offer solid rental yield potential, especially for medium- to long-term rentals, making rental property investments in the city highly attractive.

The Algarve: Growing holiday home market

The Algarve: Growing holiday home market

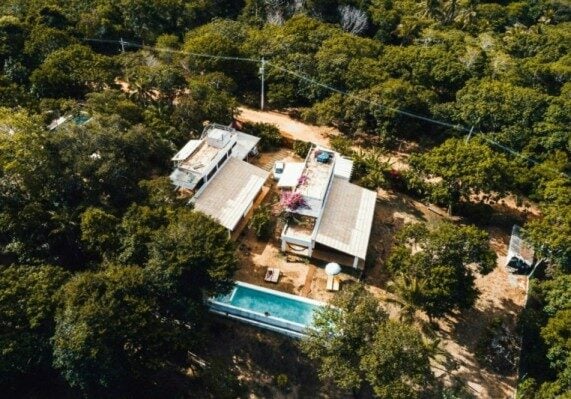

When looking for beachfront homes, holiday homes, or retirement living, the Algarve remains a favorite.

International demand is growing steadily, with areas like Lagos attracting a lot of the attention. Luxury buyers also know to head to the Golden Triangle in the Algarve (Quinta do Lago, Vale do Lobo, Almancil, and Vilamoura) for premium options.

For better value, the Eastern Algarve region offers attractive price points while still benefiting from the region’s appeal. If you are seeking stunning villas in Portugal, the Algarve is the dream location.

As a prime holiday destination, many real estate investors snap up property deals in the region for rental property, letting reliable property managers in the Algarve maximize their income.

Silver Coast and Central Portugal: Value and authentic living

Silver Coast and Central Portugal: Value and authentic living

The Silver Coast and Central Portugal regions are attracting high levels of popularity among buyers seeking affordable real estate prices and authentic Portuguese living. Nazaré, Óbidos, Coimbra, and Aveiro, Portugal real estate, are drawing attention for their residential living and investment potential.

The Silver Coast and Central Portugal regions are attracting high levels of popularity among buyers seeking affordable real estate prices and authentic Portuguese living. Nazaré, Óbidos, Coimbra, and Aveiro, Portugal real estate, are drawing attention for their residential living and investment potential.

As the city center of a place like Lisbon, Porto, and the Algarve become too pricey for some, the Silver Coast and Central Portugal are seeing increased interest, leading to potential for capital appreciation as infrastructure improves and more people discover their charm.

Places like Coimbra and Aveiro offer unique investment opportunities in the region. Home to prestigious universities, they offer excellent opportunities for student rentals, which can provide a stable income with consistent demand.

Looking for affordable properties? Check out our article on cheap houses for sale in Portugal.

Madeira and the Azores: Island appeal and digital nomad havens

Madeira and the Azores: Island appeal and digital nomad havens

Portugal’s islands are carving out a niche in the property market. Madeira, especially Funchal, has seen rising interest from remote workers, drawn by the tranquil lifestyle, mild climate, safety, and connectivity.

The Azores islands are slowly gaining the attention of eco-conscious potential property owners and retirees seeking a peaceful retirement surrounded by natural beauty.

For international investors, the Portugal housing market offers unique opportunities in hospitality, eco-tourism, and long-term rentals aimed at digital nomads.

Is now the right time for YOU? Considering Your Goals

So, after all the information we have unpacked, is it the right time to buy real estate in Portugal? Or, more specifically, is it the right time for you and your property goals?

If you’re relocating for lifestyle reasons, focus on regions that offer a great quality of life, welcoming communities, and a manageable cost of living. For investors seeking rental income or capital appreciation, it’s crucial to analyze rental yields, future price growth, and tax advantages.

Meanwhile, budget-conscious buyers can still find value in emerging areas, inland regions, or by taking on renovation projects.

Overall, the Portugal real estate market looks promising in 2025, especially for foreign buyers. With a stable economy, strong rental yields, and a high-quality lifestyle, there’s no doubt that you can find what you are looking for.

However, it’s always wise to seek professional guidance, especially if you are unfamiliar with how the processes of the Portugal housing market work. Our expert team at Goldcrest will be happy to assist you with your purchase and ensure the process is stress-free, whether you are buying to relocate or to make an investment.

What Do the Latest Mortgage Rates Mean for Property Buyers in Portugal Today?

For anyone considering buying a property in Portugal, mortgage rates are one of the most influential factors shaping affordability and timing. In recent years, rising European interest rates have slightly cooled the pace of property transactions, but Portugal remains far more accessible than many Western European markets.

Local banks continue to offer competitive financing to both domestic buyers and international buyers, including non-residents and those seeking to purchase real estate as part of a long-term investment or relocation plan.

While higher rates mean monthly repayments are steeper than during the ultra-low-interest era of 2020–2021, the broader context remains favorable. Portugal’s political stability, transparent legal framework, and high property values in cities like Lisbon and Porto mean that investors are still finding solid returns — especially in areas with strong rental demand or modern amenities.

Buyers should also budget for additional costs such as property transfer tax (IMT), stamp duty, and notary and registration fees, which can add 7–10 percent to the total purchase price. Working with a qualified mortgage broker and legal representative is highly recommended to ensure proper due diligence on the property’s legal status and compliance with local laws.

Goldcrest: How We Can Help You

Goldcrest is a buyer’s agent that is based in Lisbon. We provide expert, impartial advice on real estate investments and how to buy property in Portugal. From scouting out the perfect property through to property acquisition, we have you covered throughout the process.

If you are looking to purchase property in Portugal, don’t hesitate to get in touch. Our team of skilled experts is available to solve all your real estate doubts, helping you with the property search and offering insightful expertise and strategic advice.

Why choose Goldcrest?

- Local knowledge: With offices located across Portugal, our presence nationwide allows us to assist you personally across the country.

- Independent service: As an independent buying agent, we do not represent any development or project. Our service is entirely tailored toward each individual client, providing you with everything you need to secure the perfect property at the best possible price. As an impartial advisor on the market, we work solely on behalf of our client and provide a service tailored to your needs and requirements.

- Streamlined process: Our real estate agents speak English and Portuguese, and our service is completely focused on providing you with a hassle-free buying experience, saving you time.

- Experienced team: Our expert real estate team has a vast local knowledge of the Portuguese property market. We have cutting-edge technology and metasearch tools at your disposal to provide full market coverage, ensuring the best investment choices and negotiated prices.

- Network of partners: We have a close network of partners, including lawyers, property management services, builders, architects, designers, and landscape gardeners, again saving you time and hassle by providing you with trusted experts in their field of work.

Frequently Asked Questions About Buying Property in Portugal

Is it a good investment to buy property in Portugal?

Currently, the Portugal real estate market is thriving, presenting attractive opportunities to buy property. Foreigners buy property in Portugal because mortgage rates are low, demand is increasing, and, although prices are rising, the Portugal housing market is still more affordable than other Western European countries and the USA.

Given that Portugal continues to produce high returns on investment, including steady capital appreciation and strong rental yields, and offers an enviable lifestyle, investing in property is a smart financial move in 2025.

Are property prices in Portugal falling?

Prices of property in Portugal are generally increasing. While there may be a few places where prices remain steady, most housing prices are on the rise.

What are the current average mortgage interest rates in Portugal?

Average mortgage rates in Portugal will vary based on the type of mortgage:

- Fixed rate: 2.5 – 3.8 Percent

- Variable rate: 2.3 – 3.2 Percent

- Mixed rate: 2.70 – 3.5 Percent

What is the average house price in Portugal?

The average house price in Portugal is around €2,701 per square meter nationally. You can expect the following average home price in Portugal per region:

- Lisbon Metropolitan Area: €4,935 per square meter

- Porto Metropolitan Area: €3,937 per square meter

- Northern Portugal: €1,903 per square meter

- Central Portugal: €2,098 per square meter

- Alentejo: €3,181 per square meter

- Algarve: €4,385 per square meter

Is it better to work with a real estate agent or a buyer's agent to buy a house in Portugal?

It’s usually better to work with a buyer’s agent if you want someone who represents your interests only. While real estate agents typically work for the seller, buyer’s agents work exclusively for the buyer.

Buyer’s agents like Goldcrest are able to help you search across multiple databases, negotiate prices, and navigate legal steps. They’re especially helpful for foreign buyers unfamiliar with the Portuguese market or who do not speak Portuguese.

How long does it take to buy a house in Portugal?

If you are asking yourself, “How long does it take to buy a house in Portugal?“, it usually takes one to four months, depending on the complexity of the property purchase, legal checks, financing, and negotiations with the seller.