Updated: February 2, 2026

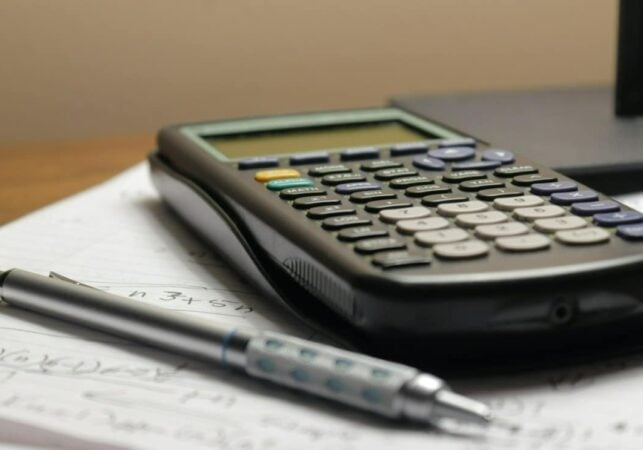

Getting a mortgage in Portugal is a straightforward process. Foreigners can obtain a loan at any bank in Portugal. Pair that with the country’s sunny weather, friendly immigration policies, and relatively low cost of living, and it’s easy to see why Portugal is such a popular option for a second home, a permanent move, or even starting a business.

However, Portugal’s favorable Non-Habitual Resident (NHR) tax scheme has been completely phased out, meaning tax benefits are now more specific and less broadly applicable than they once were. Also, non-residents typically require a larger down payment and higher interest rates compared to residents. So, there is a lot of planning that goes into applying for mortgages.

In this article, you can find everything you need to know about the typical down payment percentages, Portugal mortgage rates for non-residents, required documents, and different mortgage types in Portugal. At the end, you will be ready to compare mortgages.

Stick around to read about:

Quick Summary

- Portugal mortgage rates depend on your income, resident status, and risk assessment. As of September 2025, the rate is approximately 3 to 6 percent for foreign buyers.

- To obtain a mortgage in Portugal, you go through multiple steps. The first requirement is to meet the minimum standards set by the banks in Portugal.

- Every bank uses different spreads, including profit margins, policies, and documentation requirements.

What should you know before taking out a mortgage in Portugal?

Before you shop for a home or mortgage, you should assess your finances, set a budget, and check your credit score. If you improve your finances before applying for your first mortgage, it increases your chances of securing a favorable mortgage offer.

Before you shop for a home or mortgage, you should assess your finances, set a budget, and check your credit score. If you improve your finances before applying for your first mortgage, it increases your chances of securing a favorable mortgage offer.

To meet the basic requirements for a mortgage in Portugal, you will need:

- Good credit score: Lenders will go over your credit score with a creditworthiness analysis. They often analyze your credit liability through various databases, such as the Central Credit Register of the Banco de Portugal. This helps them determine whether their decision to lend money.

- Sufficient down payment: The minimum deposit in Portugal varies based on your residency status. Residents often need a 20 percent deposit, while non-residents require about 30 percent. But the down payment varies based on your income and risk profile. This is tied to the maximum percentage of the property value a lender is willing to finance.

- Financial stability: When you purchase property, you pay extra fees, like taxes, notary costs, and registration fees. They add 8 to 10 percent on top of the price of the home. So, you need to show the bank you can cover these additional costs with savings or liquid assets.

What is a mortgage in Portugal?

A mortgage is a loan you take out to buy or refinance a home, plot of land, or other type of real estate in Portugal. You (the borrower) sign an official mortgage agreement to pay the lender over time with interest.

A mortgage is often bigger than most other loans. You put down some money as a deposit, and then the bank lends the rest of it. The loan is tied to the home itself, which means that if you don’t pay it back, the lender has the right to take your property. The duration of this debt is known as the loan term.

Benefits of getting a mortgage in Portugal

Securing a mortgage offers many advantages to non-residents and residents when buying property in Portugal.

The Portuguese mortgage market offers:

- Access to competitive mortgage rates in Portugal: Banks often offer mortgage rates lower than those for personal loans or credit cards. For example, in 2025, rates for 20-year mortgages can start around 3.5 to 5.5 percent for well-qualified borrowers, making mortgage payments more affordable. These rates vary based on the LTV (Loan-to-Value) and the borrower’s profile.

- Financing for non-residents: Even if you don’t live in Portugal, you can still get a mortgage. For example, more foreign investors from the UK, the US, and Germany have invested in Portuguese luxury real estate in high-end areas, such as Lisbon and Porto, due to favorable mortgages and migration policies, often viewing it as a proper investment.

- Investment leverage and liquidity: By taking a mortgage, you can purchase a property without paying the full upfront price. For example, if you want a €500,000 apartment in Lisbon, you might pay €150,000 as a deposit and borrow money for the rest of €350,000. That way, you end up with more money for other investments. If you plan to rent it out, you would generate rental income.

- Longer mortgage terms: In Portugal, foreigners can get mortgages that last up to 30 years, and some banks even offer up to 40 years for borrowers under 30. For example, spreading a €300,000 loan over 30 years instead of 15 years can reduce the mortgage payments and make it easier to own your dream property.

Can foreigners get a mortgage in Portugal?

Yes, foreigners can obtain a mortgage in Portugal without restrictions. Portuguese banks regularly work with non-residents. However, the terms and conditions for non-residents are different from those for residents. Portuguese mortgage rates for foreigners use stricter policies, even for those from the EU.

How much deposit do you need for a mortgage in Portugal?

The deposit required for a Portuguese property purchase depends heavily on your residency status.

The deposit required for a Portuguese property purchase depends heavily on your residency status.

For Portuguese residents, banks typically offer a Loan-to-Value (LTV) ratio of up to 90 percent, according to the Banco de Portugal. This means you often need a minimum deposit of 10 percent to 20 percent of the property price. First-time buyers under 35 who are tax residents may even qualify for government programs offering up to 100 percent financing, eliminating the need for a deposit.

However, non-residents face stricter criteria. Banks typically limit LTV to 65 percent or 75 percent, requiring foreign buyers to put down a larger down payment, which usually ranges from 25 percent to 35 percent. Luxury properties in Portugal need a higher upfront investment. You must also budget for transaction costs, which add 8 to 10 percent to the upfront funds required. These are Property Transfer Tax (IMT), Stamp Duty Tax (0.8 percent), and notary and registry fees.

If you are planning to invest in rental properties, check our ultimate guide on mortgages for Buy-to-Let in Portugal. This type of investment relies on consistent rental income.

What types of mortgages are available in Portugal?

There are a few different mortgage loan options to choose from if you need to finance your property purchase in Portugal. Here is a quick look at the differences between fixed vs variable vs mixed rates.

1. Fixed-rate mortgage

Fixed-rate mortgages allow property owners to pay a constant interest rate for a certain period, which can range from 1 to 30 years. Banks typically charge a premium for it. The main benefit is that borrowers are fully protected against fluctuations in the Euribor rate. It gives them stability and predictable monthly payments while the fixed term lasts.

2. Variable-rate mortgage

Variable mortgages are calculated based on two components: the reference index and the mortgage spread. Those who seek cheap houses for sale in Portugal often opt for a variable-rate mortgage.

The monthly payments on variable mortgages fluctuate over time based on periodic revisions to the Euribor index. Over the repayment period, the monthly payments are typically revised every 3, 6, or 12 months, based on the Euribor term selected. If you decide on early repayment, you may have to pay early repayment fees, typically at 0.5 percent of the repaid capital.

3. Mixed-rate mortgage

This mortgage deal combines an initial fixed-rate period (often 5, 10, or 15 years) with a subsequent variable-rate period, offering a balance of stability and potential cost savings.

This type of loan has become the most popular option for new contracts and land ownership in Portugal, often accounting for well over half of new mortgages. They are a more flexible option for borrowers.

Wondering what’s new for UK nationals buying property in Portugal after Brexit? Read our guide.

Can retirees apply for a mortgage in Portugal?

Can retirees apply for a mortgage in Portugal?

Yes, retirees can get a mortgage in Portugal as long as they can demonstrate a stable income or pension income. However, it gets more difficult to find a bank to offer a mortgage after the maximum age of 70 years old.

Are there special mortgages available for businesses?

Are there special mortgages available for businesses?

Yes, specialized financing options for businesses to acquire, build, or renovate commercial property are widely available in Portugal. They are often called medium- and long-term financing solutions.

The most popular options are:

- Commercial real estate credit (Crédito Imobiliário): A traditional mortgage secured by the property.

- Real estate leasing (Leasing Imobiliário): The bank buys the real estate and leases it to the company, often covering up to 100 percent of the investment value.

These products are tailored based on the company’s creditworthiness and the economic feasibility of the specific real estate project. This often requires providing business bank statements.

If you are interested in Portuguese property purchase, check our ultimate guide to Portugal real estate investment.

Mortgage Rates in Portugal

As of September 2025, mortgage rates in Portugal vary from 3 percent to 6 percent. They depend on your resident status, income, and risk assessment.

Portugal mortgages for non-residents

Portugal mortgages for non-residents

The Portugal mortgage rates for foreign buyers vary from 3 percent to 6 percent. For non-residents, Portuguese banks typically require a deposit of 20 percent to 30 percent of the property value. In other words, you can borrow 60 percent to 80 percent of the cost. Over the past few years, mortgages have become more accessible to international buyers, with different banks creating special products and services tailored specifically for foreigners.

The table below provides an overview of the mortgage rates Portugal based on what the average local market offers from major banks and lenders.

Feature | Average range for foreigners | Best-case scenario |

Fixed interest rate | 3.5 - 4.5 percent | 3.0 - 3.5 percent |

Variable interest rate | 3.5 - 4.5 percent | 3.0 - 4.0 percent |

Down payment | 20 - 30 percent | 20 percent |

Maximum Loan-to-Value (LTV) ratio | 60 - 80 percent | 80 percent |

Length of mortgage term | 20 - 30 years | Up to 40 years |

Monthly payment (20-year term, €200,000, 4 percent) | €1,055 | €950 - €1,055 |

Average processing time | 4 - 8 weeks | 3 - 4 weeks |

Source: Investropa

Portugal mortgages for residents

Portugal mortgages for residents

Most residents pay about 3.5 percent to 5.5 percent, depending on their bank and borrower profile. Most banks require a deposit of 10 percent to 20 percent of the property price. In other words, you can borrow 80 percent to 90 percent of the cost.

Mortgage rates in Portugal remain competitive, offering low interest rates that can be highly beneficial for local buyers.

Feature | Average range for foreigners | Best-case scenario |

Fixed interest rate | 3.0 - 4.0 percent | 2.8 - 3.3 percent |

Variable interest rate | 3.0- 4.0 percent | 2.5 - 3.5 percent |

Down payment | 10 - 15 percent | 10 percent |

Maximum Loan-to-Value (LTV) ratio | 85 - 90 percent | 90 percent |

Length of mortgage term | 30 - 40 years | Up to 40 years |

Monthly payment (20-year term, €200,000, 4 percent) | €950 - €1,000 | Less than €950 |

Average processing time | 2 - 4 weeks | 1 - 2 weeks |

Find out more about low interest rates in Portugal: What’s in Store for Mortgages.

How much can you borrow for a Portuguese mortgage?

In Portugal, getting a full 100 percent mortgage offer is rare. If you’re a Portuguese resident, banks typically lend up to 90 percent of the property’s price. For foreign buyers, the maximum percentage is often around 80 percent, and sometimes even less. Many Portuguese banks only offer 60 percent, depending on your financial history. So don’t assume you’ll get the maximum amount.

In Portugal, getting a full 100 percent mortgage offer is rare. If you’re a Portuguese resident, banks typically lend up to 90 percent of the property’s price. For foreign buyers, the maximum percentage is often around 80 percent, and sometimes even less. Many Portuguese banks only offer 60 percent, depending on your financial history. So don’t assume you’ll get the maximum amount.

Portuguese banks calculate mortgages based on the lower of two values: the appraised value or the agreed purchase price of the property. If the appraisal comes in lower than the price you agreed to pay, your mortgage will be based on that lower amount. This means you may need to cover more of the cost yourself, so it’s important to plan ahead.

Before approving a mortgage deal, the bank usually arranges a property valuation (Avaliação). They will use a certified appraiser, but if you prefer to use your own, check first to see if the bank will accept it. The bank will also require a valuation report before issuing the final mortgage offer.

If you want to buy villas in Portugal, check our article to find the best places for investment.

What are the main mortgage conditions and requirements?

Here are the mortgage requirements that determine your ability to borrow money in Portugal:

- Your income bracket and buying profile, including providing tax returns

- The type and location of the property you buy

- Monthly mortgage charges

- Your monthly spending limit (DTI)

- Your income rate (especially important for self-employed applicants and confirming rental income)

- The appraisal value or agreed purchase price

- The current interest rates

- Maximum equity you plan to contribute

The required documents for the mortgage application process include:

- Copy of valid passport

- Portuguese tax number (also called a NIF number)

- Proof of income (pay slips for employed or tax returns for self-employed)

- Recent bank statements

- A recent utility bill

- Recent mortgage statements

- Proof of any savings or investment income accounts

- Bank reference letters

- Property details – buying commitment or sales contract, and copies of the existing property deeds.

How to apply for a mortgage in Portugal?

The application process begins when you contact a bank or mortgage broker. Every applicant may meet different requirements. Having an experienced mortgage agent on your side will make securing the best mortgage deal for your situation much simpler.

Here are the steps to get started:

- Check your income, savings, and good credit score.

- Choose a property you want to buy and obtain a Promissory Contract (CPCV). If it is a rental one, you may also need a tenancy agreement to confirm rental yields.

- Receive a mortgage pre-approval (simulação de crédito). This is an initial assessment.

- Follow the requirements set by your bank, like property appraisal and paying the bank valuation fee.

- Submit your mortgage application and pay the upfront costs.

- Sign the property and mortgage deeds (Escritura de Hipoteca) in front of a Portuguese notary on the completion date.

Which Portuguese banks offer the best mortgages for foreign buyers?

Many banks in Portugal work with foreigners who apply for mortgages. However, a few stand out due to their mortgage rates and financing options. The table below can help you choose the best bank for foreign buyers.

Bank Name | Best for | Main advantage | What you can expect |

Novobanco | Foreign buyers | Multilingual customer service, documents in English or Portuguese | Low fixed rates depending on profile; financing 70 to 80 percent of home value |

Eurobic | Personalized mortgage solutions | Fast application process | Financing 60 to 80 percent of home value; slightly higher equity needed |

BPI (Grupo CaixaBank) | Security-conscious foreign buyers | Support for clients with accounts at CaixaBank | Fixed or variable rates; up to 80 percent for primary homes, and 70 percent for holiday homes |

Santander | Buyers seeking long-term, flexible loans | Extensive branch network in English | Fixed or variable rates; maturities up to 40 years |

Bankinter | Digital-first, convenience-focused buyers | Online tools and competitive rates | Financing up to 80 percent of home value; manage mortgage online |

Banco CTT | Buyers who want transparency | No hidden fees | Financing 70 to 75 percent of home value; limited English support |

UCI | High-net-worth foreigners | Expert guidance for expats | Customized mortgages; wide financing options; higher interest rates |

Practical Information to Know about Mortgages in Portugal

In addition to the application process and the associated costs, here are some other practical details to consider regarding the maximum loan-to-value and the lending criteria for a mortgage in Portugal.

How much does a mortgage cost in Portugal?

If you’re financing your purchase, Portuguese banks offer mortgages to non-residents, although conditions vary.

Here’s what to expect in 2025:

- Loan-to-value (LTV): Up to 80 percent for residents, around 60 to 80 percent for non-residents

- Interest rates: Around 3.5 to 5.5 percent for variable or fixed mortgages

- Mortgage setup fees: Often vary from 1 to 1.5 percent of the loan amount

- Life and home insurance: Banks can require it alongside the loan. You can read more about it in our guide for banking in Portugal.

- Property valuation: Can cost anywhere from €300 to €600

Ongoing costs can also occur after purchase with property ownership in Portugal. As an owner, you can expect:

- Municipal Property Tax (IMI): 0.3 percent to 0.45 percent per year, based on the property’s taxable value (VPT)

- Condominium fees: If you buy an apartment, the ongoing costs can vary from €20 to over €300 per month

- Utilities and insurance: Typical expenses require an average budget of €100 to €200 per month.

You can learn more about the total cost of ownership in our comprehensive guide.

If you need help with legal matters, a real estate lawyer in Lisbon can perform due diligence, resolve cases, and create legal documents.

What are the lending criteria for a mortgage in Portugal?

Portuguese banks will consider your ability to pay the mortgage for the whole term in the application process. To establish your affordability and how much you can borrow, the bank will calculate your debt-to-income ratio (DTI) rather than just looking at your annual income.

This ratio compares your total monthly debt obligations (existing loans, rent, credit card debt, and your future mortgage repayment) to your total monthly income. For example, if you earn €4,000 monthly and have €1,000 in monthly debt payments, your DTI ratio is 25 percent.

The Central Bank of Portugal advises a debt-to-income ratio of at least 50 percent (in other words, your income should be double the amount of your debt repayments); however, most Portuguese banks prefer a DTI of no more than 45 percent.

Stricter lenders may even set the limit as low as 35 percent, especially for borrowers with less stable income or fewer assets. On the other hand, high-net-worth individuals with strong financial profiles may be allowed a DTI of up to 50 percent.

This is a very simplified description of how the bank makes its decision. Each institution will also consider other financial indicators, like your credit score, before making a loan offer. Always consult the bank or a real estate lawyer in Portugal for a more accurate assessment.

If you are planning on buying property in Lisbon, Porto, and the Algarve, you can find large expat communities who’ve already invested in the area.

Competitive mortgage rates in Portugal for Americans

Portugal offers some of the most competitive mortgage rates in Europe, particularly when compared to those in the USA. Portuguese mortgage rates currently range from 3 to 6 percent, depending on the loan type and the applicant profile. In the USA, mortgage rates often surpass 7 percent, making the cost of borrowing much higher.

See our full guide to mortgages in the USA vs Portugal for a deeper comparison.

Goldcrest: How We Can Help You

Goldcrest is a buyer’s agent that is based in Lisbon. We provide expert, impartial advice on real estate investments and how to buy property in Portugal. From scouting out the perfect property through to property acquisition, we have you covered throughout the process.

If you are looking to purchase property in Portugal, don’t hesitate to get in touch. Our team of skilled experts is available to solve all your real estate doubts, helping you with the property search and offering insightful expertise and strategic advice.

Why choose Goldcrest?

- Local knowledge: With offices located across Portugal, our presence nationwide allows us to assist you personally across the country.

- Independent service: As an independent buying agent, we do not represent any development or project. Our service is entirely tailored toward each individual client, providing you with everything you need to secure the perfect property at the best possible price. As an impartial advisor on the market, we work solely on behalf of our client and provide a service tailored to your needs and requirements.

- Streamlined process: Our real estate agents speak English and Portuguese, and our service is completely focused on providing you with a hassle-free buying experience, saving you time.

- Experienced team: Our expert real estate team has a vast local knowledge of the Portuguese property market. We have cutting-edge technology and metasearch tools at your disposal to provide full market coverage, ensuring the best investment choices and negotiated prices.

- Network of partners: We have a close network of partners, including lawyers, property management services, builders, architects, designers, and landscape gardeners, again saving you time and hassle by providing you with trusted experts in their field of work.

Frequently Asked Questions about Mortgage in Portugal

What types of mortgages are available in Portugal?

In Portugal, homebuyers can choose between fixed-rate and variable-rate mortgages or a combination of the two, known as mixed-rate mortgages.

What are current mortgage rates in Portugal?

As of September 2025, mortgage rates in Portugal vary from 3 percent to 6 percent. Portuguese mortgage rates vary based on your resident status, income, and risk profile.

How to get a mortgage in Portugal?

Portuguese banks offer mortgages to resident and non-resident applicants. If you do not have a fiscal representative or a buyer’s agent, you can approach a major Portuguese financial institution, such as Novobanco, Eurobic, and Santander, directly.

What are the benefits of taking out a Portuguese mortgage for foreigners?

The key benefit of taking out a Portuguese mortgage is that Portuguese mortgage lenders can offer valuable services and benefits that include property valuation to take place, tailored interest rates, and favorable repayment terms.

Can a foreigner get a mortgage in Portugal?

Yes, foreigners can get a mortgage in Portugal without restrictions. This includes UK and US citizens. If you are buying property to rent out for long or short-term rentals in Portugal, it is possible to get a mortgage. A mortgage lender will only deem your application unsuccessful if you do not meet the eligibility criteria.

What are the Portugal mortgage interest rates?

In Portugal, mortgage interest rates have been slowly decreasing since 2024. According to Statistics Portugal, the rates for all outstanding home loans in 2025 were: 3.48 percent in June, 3.39 percent in July, and 3.31 percent in August.

Can I get a mortgage in Portugal from the UK?

Yes, mortgages in Portugal for UK residents are possible. Both Portuguese residents and non-residents can apply for mortgages in Portugal.

What are the mortgage conditions in Portugal?

Conditions vary, but often include a loan-to-value ratio of 60 to 80 percent, with a down payment of 20 to 30 percent typically required for non-residents. The mortgage term is usually between 25 and 30 years.

Is it hard to get a mortgage in Portugal for EU Citizens?

Banks have stricter policies and mortgage rates in Portugal for non-residents. But these factors don’t deter EU citizens, because mortgage options for Portugal property buyers are more accessible than in some other Western European countries like France, Germany, and the Netherlands.