Updated: April 2, 2024

Portugal has become a haven for expats seeking a new beginning in an enchanting European country. With its rich cultural heritage, stunning landscapes, and warm Mediterranean climate, Portugal has emerged as a sought-after destination for expats looking to invest or settle down.

From the historic cobblestone streets of Lisbon to the sun-kissed beaches of the Algarve, Portugal offers a diverse range of real estate options to suit every taste and budget. Whether you’re searching for a charming villa in a picturesque village or a modern apartment in a cosmopolitan city, Portugal has something to offer all types of expats looking to call this beautiful country home.

Whilst setting up life in a new country can seem scary and the act of buying real estate overwhelming, with the right guidance, it doesn’t have to be. In this article, we’ll demystify the processes for buying property in one of Europe’s most desirable locations and explain some common industry jargon for the Portuguese real estate market.

Portugal Real Estate Market: An Overview

Over the past decade, the property market in Portugal has experienced significant growth and transformation, making it an attractive destination for expats seeking property investments. Since the country emerged from the global financial crisis in 2013, Portugal has witnessed a remarkable recovery in its real estate sector.

One of the key factors driving this growth has been the introduction of the Golden Visa program in 2012. This initiative allows non-EU citizens to obtain residency in Portugal by investing in real estate, leading to a surge in demand from international buyers. The program, along with Portugal’s attractive tax incentives and relatively low cost of living, has made the country an enticing option for expats looking for a European base.

Cities such as Lisbon and Porto have experienced a remarkable revitalization, with urban regeneration projects and increased foreign investment injecting new life into these vibrant urban centers. The rise of digital nomads and remote workers has also contributed to the demand for real estate as professionals seek a flexible work-life balance in Portugal’s welcoming and affordable environment.

In terms of property types, apartments, and villas have been in high demand, both for residential purposes and short-term rentals, driven by the growth of tourism in the country. Coastal areas, such as the Algarve, have remained popular due to their stunning beaches and pleasant climate, attracting expats looking for second homes or retirement destinations.

While the market has been buoyant, there have been concerns about rising property prices, particularly in prime locations.

However, Portugal still generally offers comparatively affordable options compared to other European countries, making it an appealing choice for expats seeking real estate opportunities.

All in all, the real estate market in Portugal has undergone a remarkable transformation in the past decade, fueled by favorable government initiatives, increased foreign investment, and a growing interest from expats. With its blend of natural beauty, rich history, and welcoming culture, Portugal continues to be an alluring destination for expats looking to invest in the country’s real estate market.

Property Prices in Portugal

The price of real estate in Portugal, like in any other country, varies depending on the location. The choice of location for your property purchase will depend on the purpose behind your investment.

Investors typically gravitate towards major cities like Lisbon or Porto, as they offer proximity to thriving trading centers. On the other hand, retirees often prefer more relaxed and scenic areas such as Cascais or the Algarve.

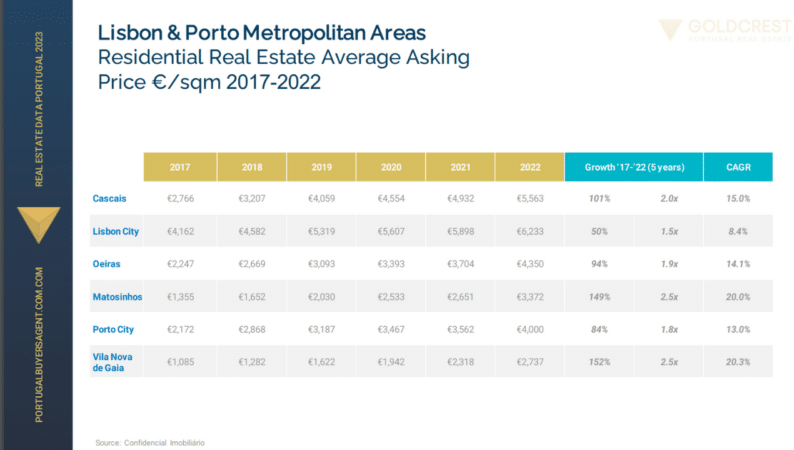

In the next sections, we will delve deeper into different locations in Portugal and explore the advantages of buying property in each. But first, let’s take a look at a table showcasing the average property purchase price in various cities:

Where to Buy Property in Portugal

Where you buy property in Portugal will depend on your budget, your preferences, and needs. Life in the middle of a busy city is always more expensive, and this is also the case for the prices of property. However, choosing a property on the outskirts of a city or town or moving to the countryside can bring down real estate prices without compromising on the quality of your new home.

Below we’ll give you a brief overview of some of Portugal’s most popular cities and areas for buying real estate.

Lisbon

Lisbon, the capital city of Portugal, is a vibrant and lively destination situated at the heart of the country. Expats and investors often regard Lisbon as one of the most affordable European capitals, offering a high quality of life. In recent years, the city has experienced a surge in economic growth, primarily driven by the emergence of tech companies and startups.

Lisbon’s real estate market has rapidly expanded over the past few years, and this has also been evident in real estate prices. Certain districts within the city have witnessed a significant increase in the average property purchase price. Notably, Avenida da Liberdade, Lapa, and Baixa Chiado have become sought-after areas.

Despite the rising prices, many buyers and investors continue to explore real estate investment opportunities in these trendy and popular neighborhoods.

If city center prices are too steep, then looking a little on the outskirts is a great way to enjoy both city life and affordable housing and cheap property. Plus, with Lisbon’s great public transport links, you’re never far away from the hustle and bustle of this vibrant city.

Porto

This charming fishing city offers a delightful blend of culture and metropolitan living, making it a desirable investment destination. The property market in Porto is thriving, with notable growth in recent years. Many expats relocating to Portugal opt for Porto due to its stunning Atlantic views and the availability of luxurious beachfront properties.

Moreover, Porto’s real estate market stands out for its abundance and diversity of properties. Foz do Douro is renowned for housing some of the world’s finest Atlantic beachfront properties, while Ribeira appeals to buyers seeking commercial real estate opportunities.

The Algarve

The Algarve, Portugal’s most southern region and a haven for beach lovers and water sport enthusiasts attracts investors and expats alike due to its wide range of property options. From apartments with ocean views to sprawling luxury villas, the region offers an abundance of choices.

Some of the best-known cities of Portugal are located in the Algarve, such as Faro, Lagos, Tavira, and Albufeira. Faro is also home to Portugal’s third international airport, making it an excellent place for expats with international travel needs.

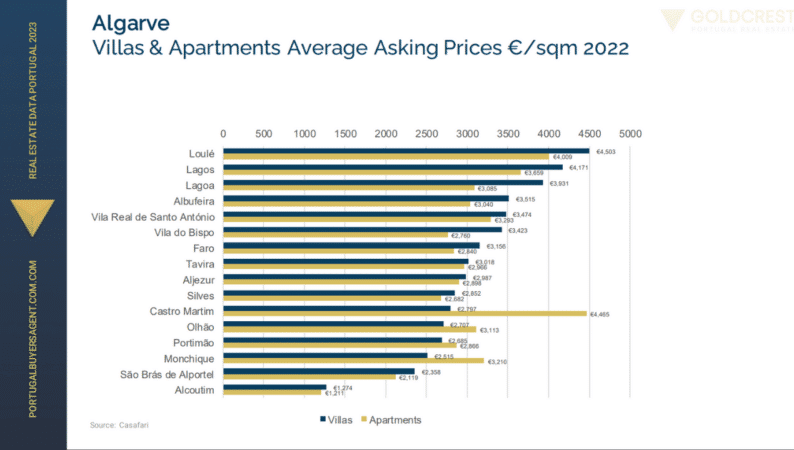

Certain neighborhoods in the Algarve command higher prices, such as Vilamoura, renowned for its luxurious homes and villas. Other upscale real estate options can be found in Lagos and Albufeira. However, for more affordable opportunities, Alcoutim and Monchique are worth considering, especially if you’re after a renovation project.

It’s important to note that the Algarve region has consistently demonstrated its economic and touristic growth, making it a desirable investment destination in Portugal.

The above graph shows the average asking prices for property in the Algarve in 2022, but that, as you can see, some parts are pricier than others.

The Silver Coast

Portugal is blessed with breathtaking beaches, encompassing both the Lisbon Coast and the Silver Coast. Stretching between Lisbon and Porto, the Silver Coast boasts stunning beaches and exceptional beachfront properties.

Locations like Peniche, Óbidos, and Nazaré offer attractive high-end real estate opportunities at relatively lower prices compared to the Algarve region. It’s worth mentioning that these areas are less densely populated, providing a tranquil and unhurried lifestyle for those seeking a quieter atmosphere.

Type of Real Estate in Portugal

Portugal is a highly developed country, and its real estate market reflects this progress. The property options in Portugal span from cozy studio apartments to grand, opulent villas along the coastline. Whether you’re looking for the best Atlantic beachfront properties, private property, or commercial properties, Portugal has it all.

House terminology

You will find a variety of properties in Portugal, and below are those you will encounter most frequently when you’re searching for real estate:

“Casa” or “Moradia”

These terms refer to a classic standalone residence or detached property. Many of these houses come with amenities like a backyard or patio, and they typically feature a surrounding wall with a front gate, adding to their traditional charm.

Casa Geminada

This term is used to describe a semi-detached house. A semi-detached house is a type of housing unit that shares one common wall with a neighboring house.

“Condominios” or “Condos”

These refer to individual apartment buildings. These buildings usually share some common areas and tend to be a bit on the pricy side. However, they do offer a higher standard of care and safety.

Quintas

This term is used to describe traditional, rustic houses or farms. These types of properties are typically found in rural or countryside areas, although some can also be found in suburban locations.

Terreno

The term “terreno” simply means “land.” Some expats choose to buy land and construct their own homes in Portugal. It’s important to note that certain land in Portugal is designated for agricultural use. Therefore, it’s recommended to verify with the local city hall (Câmara Municipal) whether the land is registered for residential purposes before making any purchases.

Apartment terminology

Once your search for a property has started and you’re scrolling through real estate websites, you may come across symbols like “T0, T1, T2,” and so on. These symbols indicate the number of rooms in an apartment. For example, “T2” stands for a two-bedroom apartment with all the necessary amenities, while “T0” refers to a studio apartment.

You may also come across a “+1” next to the designation, such as “T2+1”. This indicates a two-bedroom apartment with an additional room that does not have windows. Note that the same terminology applies to houses: A “T3” property stands for a three-bedroom house etc.

How to Find Real Estate in Portugal

When you buy property in Portugal, it is advisable to seek the assistance of a real estate agent known as Imobiliária. All real estate agents in Portugal are assigned a license number by the Portuguese Association of Real Estate Agents (Associação de Mediadores Imobiliários). Before engaging in any transactions with a Portuguese real estate agency, it is important to verify their registration.

A much easier way to find your perfect new home is to enlist the help of a buyer’s agent such as Goldcrest. A buyer’s agent does all the hard work for you, finds the best properties according to your needs and budget, and can do the negotiating on your behalf. They solely work for you and have your best interest at heart at all times.

A Step-by-Step Guide to Buying Real Estate in Portugal

Below is a short step-by-step guide to purchase property in Portugal:

Acquiring a NIF Number

The NIF number is a tax identification number issued by the government finance office and is required to open a bank account and carry out financial transactions in Portugal. You can obtain this number by either applying for it yourself or hiring an attorney to assist you. Our colleagues from GetNIF can help you with both getting your NIF number and opening a bank account.

Selection of property

During this stage, you can browse properties online or visit them in person in Portugal and choose the one that best suits your needs.

Mortgages

If you plan on financing your purchase with a mortgage, you should explore different mortgage options and select the one that is most suitable for you.

Negotiating

Generally, there is room for negotiation when purchasing a property. We recommend initiating negotiations with the seller to reach mutually agreeable terms.

Signing the CPCV

We would advise that, at this stage, you sign a Contrato-Promessa De Compra e Venda (CPCV), a temporary sales and purchase contract. This contract provides both parties with a guarantee while awaiting the final signing of the deed.

Signing the property deed

Once all the details are agreed upon, you will need to sign and notarize the property deed (Escritura Pública de Compra e Venda).

Required Documents for Buying Real Estate

As mentioned above, one essential part of doing any business transactions in Portugal is having a bank account and your NIF number. Additionally, a notary has to be present as a witness when you sign the sales contract for your new property. The required documents for the purchase process include the following:

- Photo ID: A valid identification document

- Contrato promessa De Compra e Venda (CPCV): The sales contract that outlines the terms and conditions of the property purchase.

- Energy Certificate: This document provides information about the property’s energy efficiency and must be presented to you.

- Imposto de Selo: The stamp duty payment, which is a tax required for property transactions.

- Carderneta Predial: The land register document that contains information about the property, such as its location, boundaries, and registered owner.

Down Payment and Mortgages

Getting a mortgage is a crucial step in the home-buying process. We recommend addressing your mortgage early on to determine your affordability and monthly payments. When considering a mortgage in Portugal, there are several factors to take into account:

The lending terms

Portuguese lenders offer mortgages to eligible individuals, including foreigners, to support economic growth, real estate development, and currency circulation. The loan terms can extend up to 50 years for residents and typically 30 years for non-residents. However, there is usually a maximum age limit upon loan maturity, ranging from 70 to 80, depending on the lender.

The down payment and the deposit

Borrowing can start from 60 percent to 80 percent of the property value, depending on the lender. Therefore, it’s important to have a minimum deposit of 20 percent prepared.

Types of mortgages

In Portugal, there are two common types of mortgages: variable rate and fixed-rate.

Variable rate mortgage

The European Central Bank (Euribor) sets the interest rate margin tied to the Portuguese variable rate mortgage, which is determined daily by a panel of European banks. Early redemption of a variable rate mortgage incurs a penalty of 0.50 percent.

Fixed-rate mortgage

With a fixed-rate mortgage, the interest rate remains constant throughout the mortgage period, which can range from one to thirty years. Afterward, the mortgage may convert to a variable rate unless otherwise specified. Early redemption of a fixed-rate mortgage carries a penalty of two percent.

How can you qualify for a mortgage?

During the mortgage application process, the bank evaluates two criteria: your financial position and property valuation.

Financial position

The bank will assess your income, including salary, pension, dividends, rental income, and investment returns. They will also consider your employment history and existing debts to ensure your ability to make monthly payments.

Property evaluation

A bank-appointed engineer or property surveyor will evaluate the property you intend to purchase. Portuguese banks typically lend between 60 percent and 80 percent of the property value.

Required documents for getting a mortgage

To apply for a mortgage, you’ll need the following documents:

- Your passport

- Your NIF number

- Proof of address (such as a recent utility bill)

- Credit report

- Recent payslips

- Recent bank statements

- Most recent tax return

- Home and life insurances

You may also find the following article from our sister company useful:

Real Estate Taxes

The main tax to consider when purchasing real estate in Portugal is the IMT (Imposto Municipal sobre Transmissões), which is the property transfer tax. The IMT rate varies based on factors such as residency and property value.

Non-residents in a tax haven may face a higher rate of up to ten percent, while those buying a low-cost property as a second home may have a lower or zero rate. To understand the specific costs in your situation, it is advisable to seek professional advice. Our sister company Global Citizen Solutions offers a tax calculator which could be helpful for you.

In addition to the IMT, there are other taxes and fees to be aware of, including:

Imposto Municipal Sobre Transmissões (IMT)

Imposto Municipal sobre Transmissões Onerosas de Imóveis (Municipal Tax on Onerous Transmissions of Real Estate) is based on the property’s value and may be higher for second or third homes.

Land registry and notary fees

Land registry fees are €250, and notary fees are around €1,200of the property value.

Stamp duty

The stamp duty is a fixed fee of 0.8 percent of the property’s value.

It’s important to consider these taxes and fees when budgeting for your real estate purchase in Portugal. If you need more information on property tax or immovable property tax then consult your local tax office, where tax officials will be able to help.

You may also want to bear in mind any legal fees that you’ll have to cover when you purchase real estate, adding to the costs on top of the purchase price.

In Summary

Buying real estate in Portugal as an expat may seem like a daunting process with many unfamiliar steps ahead of you, but with the right guidance and help, the experience can be completely painless and problem-free. That’s why working with a buyer’s agent can really make the whole experience easier and quicker for you.

A buyer’s agent, such as Goldcrest, can do all the hard work for you, source properties, negotiate prices, and we’ll always have your best interests at heart.

Here at Goldcrest we can help you find your perfect home tailored to your needs, and our sister companies Global Citizen Solutions and GetNIF are on hand to help you with your residency needs and assist you in getting your Portuguese tax number. Our dedicated team is committed to providing a top-notch service and ensuring that every step of the process is handled with care.

With over a decade of experience in the local real estate market, we have acquired valuable insights and established strong connections throughout the country. This allows us to offer you exclusive access to a curated list of properties and investment opportunities.

Don’t hesitate to reach out to us now and let us take care of the process, guiding you toward finding exactly what you’re looking for. Your satisfaction is our priority.

The following articles may also be of interest to you: